Summary

Company payments to governments related to oil, gas and minerals are often levied on a project-level basis, i.e. per individual legal agreement giving rights to an extractive deposit. Government entities collecting such payments also record the receipts by project in their internal systems, often with the exception of general taxes such as corporate income tax, which is typically (but not always) levied and recorded by legal entity.

Public disclosure of payments and revenues by project (also called “project-level” or “project-by-project” reporting) enables the public to assess the extent to which the government receives what it ought to from each individual extractive project, because actual payments can be compared with the terms set out in the laws or contracts governing the project.. Project data can help tax administrations address possible tax evasion or avoidance by shedding light on pricing arrangements and identifying risks of transfer pricing manipulation.

For host communities, it can contribute to show the benefits that each extractive project generates and can enable subnational government entities to calculate their share of project-level income. It can also assist governments in making more accurate forecasts for future changes in revenues. In terms of costs and benefits of project-level reporting in the EITI, it has been pointed out by government agencies in particular that reporting by project would be easier than current reporting of aggregates, as it would be more consistent with how governments levy and record payments or revenues. This could reduce time, costs and discrepancies in EITI Reporting. The investor community has also been supportive of project-level reporting, noting how such reporting can contribute to a more stable investment climate and improve investors’ ability to manage risk.

The EITI Standard requires that financial disclosures must be disaggregated by project for reporting covering fiscal years ending on, or after, 31 December 2018. This guidance provides a step-by-step guide on how to report “project-by-project”, including how to apply the definition of a project, how to identify the level of disaggregation for each revenue stream, as well as who should report.

How to implement Requirement 4.7

Step 1: Identifying legal agreements under the definition of ‘project’

The EITI requires that implementing countries report financial data by project, applying a definition based on emerging practices in different jurisdictions to ensure consistency with globally applicable mandatory payment disclosure rules. A project is defined as “operational activities that are governed by a single contract, license, lease, concession or similar legal agreement, and form the basis for payment liabilities with a government.” In practice, what constitutes a project is often linked to the forms of legal agreement(s) governing extractive activities between the government and companies. In other words, in a production-sharing regime, a project is typically the contract that gives rise to payment liabilities. In a tax/royalty regime, a project is typically the license that gives rise to payments.

In order to apply the definition while taking relevant national laws into account, the multi-stakeholder group (MSG) is advised to explore the following questions

1. What are the types of legal instruments governing the extractive activities in the country?

To ensure that the definition of the term ‘project’ is consistent with national laws and systems, the MSG is advised to gain an understanding of the types of legal instruments that govern extractive activities in their country. Legal instruments can take many forms, and EITI Requirement 4.7 makes explicit reference to contracts, licenses, leases, concessions or similar legal agreements governing rights to develop oil, gas and minerals. Legal instrumentsHideOften legal instruments are covered by EITI Requirements concerning legal framework (2.1), license allocations (2.2), as well as contract and license disclosures (2.4). may have other names depending on the country: Armenia has both mineral extraction permits and subsoil use contracts; in Nigeria there are licenses, production sharing agreements, joint venture agreements and other form of contracts; in Papua New Guinea there are legal instruments called ‘tenements’; while in Chad and Dominican Republic there are, amongst other instruments, concessions. It is recommended that the MSG produces a list of the types of instruments that exist and should therefore fall under the definition of ‘project’.

2. Are substantially interconnected legal agreements an issue in the country?

The definition of “project” in Requirement 4.7 makes reference to “substantially interconnected” legal agreements which may be grouped together to form one project in cases where such legal agreements (which may sometimes be governed by an overarching agreement) are both:

- operationally and geographically integrated

- and have substantially similar terms.

The definition of project was designed to apply in various jurisdictions and therefore allows some flexibility. While the wording relating to‘substantially interconnected agreements’See the International Association of Oil & Gas Producers’ (IOGP) Report 535: The Reports on Payments to Governments Regulations 2014 Industry Guidance, page 35 is open to different interpretations, for the purposes of EITI reporting MSGs should follow the guiding principle that project level payments should be reported in relation to the legal agreement which forms the basis for payment liabilities with the government.

3. Documenting the relevant legal instruments

Once the MSG has considered the points above and applied the definition of a project in their country, it is recommended that the legal instruments identified as projects are documented in MSG meeting minutes. A practical approach could be for the MSG to adapt the following “definition template”:

“In [country], a [mining]/[oil and gas] project is defined as operational activities that are governed by a single [contract, agreement, concession, license, lease, permit, or title] and form the basis for payment liabilities with a government."HideMost countries that have begun to design project-level reporting have adopted this or similar applications of the definition, including Albania, Armenia, Germany, Mongolia, Trinidad and Tobago, Ukraine, the United Kingdom and Zambia.

The MSG could also identify any substantially interconnected agreements and overarching agreements (see question 2 above).

Step 2: Identifying which revenue streams should be reported by project

The EITI requires that only payments that are levied on a project level be disaggregated: “Where a payment covered by the scope of EITI disclosures is levied at entity level rather than at project level, the company may disclose the payment at the entity level” (Requirement 4.7).

Understanding the fiscal regime, and distinguishing between payment liabilities levied on a entity (company) and those levied on licenses or other legal agreements, will help clarify which revenue streams should be disaggregated by project and those that are only subject to be disaggregated by company. The MSG is therefore advised to explore the following questions:

1. Which extractive sector payment types are levied or imposed on a project basis, and which are levied on a company basis?

Extractive-specific revenue flows like production entitlements, profit oil, royalties, bonuses and license fees are typically levied by project, meaning that a company (or other legal entity) owes a certain payment to government because it holds mining rights through a license or contract. Other payments like corporate income tax are levied in relation to the legal entity or entities holding the license, in most casesHideSome exceptions to this rule may occur; some countries require financial accounts for certain activities or operations to be ring-fenced, and in such cases even general taxes tend to be levied by project..

The MSG is advised to review the identified agreements, to consult applicable laws and model contracts and generally to gain an understanding of what taxes, fees and other payments extractive companies are required to make to the government.HideRequirements on legal and fiscal framework (2.1) and comprehensiveness (4.1) also apply. Please consult Guidance note 13: EITI (2016), ‘Guidance note on defining materiality, reporting thresholds and reporting entities. Typical revenue streams include royalties, corporate income tax, production share, dividends, bonuses and fees. The MSG may wish to consult relevant ministries, tax collecting entities, and extractive companies in order to gather a complete picture of all existing revenue flows.

Some revenue streams, such as corporate income tax, that must be included in EITI reporting are usually levied or imposed on a company as a whole and not project by project. The EITI Standard recognises that such payments may be disclosed at entity level without artificially allocating them among particular projects:

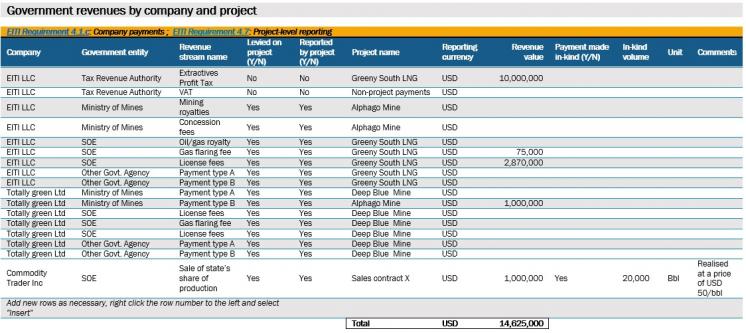

As an example of future EITI reporting, a fictitious company, EITI Petroleum Ltd, could report its payments for three projects as presented in the table below. Royalties, license fees and production entitlements are all attributable to the specific projects, while general taxes and fees are imposed on the companies overall activities. The table below illustrates how a country could ensure that revenues are disclosed by individual project, where applicable:

Sometimes, the definition of a revenue stream can help determine whether a particular payment is levied on a project or an entity basis. For example, in Burkina Faso there are so-called area/surface taxes (Taxes Superficiaries). As this payment obligation is named a tax, it could suggest that it is a payment which is not levied on the basis of licenses. However, by examining the definition of the payment obligation it is clear it is levied on a project level. These are annual payments every holder of a mining title is obliged to make based on the area-size covered by a license. The liability of rights-holders in this case is mandated by law, through Burkina Faso’s Mining Code and two additional decreesHideITIE Burkina Faso (2018), ‘2016 Burkina Faso EITI Report’, p. 158. .

Other payments levied on projects include production shares/entitlements (sometimes also known as profit oil), a common feature of production sharing agreements and contracts (PSAs/PSCs). In these instances, the agreements between companies and the state gives rise to payment obligations of companies, less allowable expenditures or “cost oil”. As the agreements give rise to the production entitlements of the government, these payments are therefore levied on a contractual or project basis. As a company may have multiple agreements or contractual arrangements, they are levied by project and should be reported as such.

2. Are there any obstacles to disclosing payments levied at a project level?

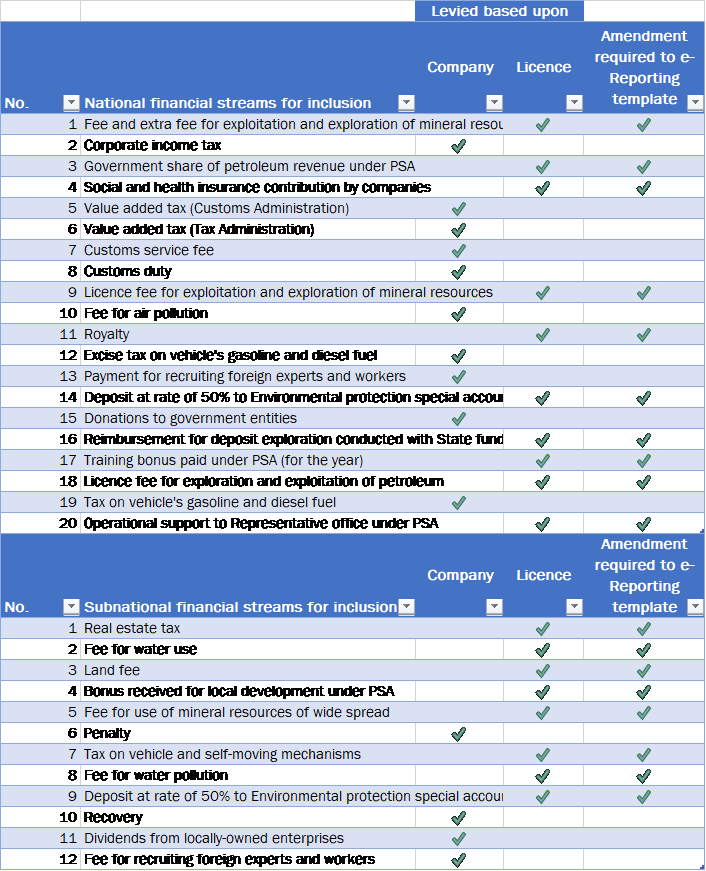

In reviewing how revenue streams are levied, the MSG should also look out for any practical obstacles to project level reporting and reform needs. As documented in the case study on Mongolia below, government record keeping systems might not always enable project level disclosure. In Mongolia’s latest EITI Report for 2017, the MSG assessed the feasibility of disclosing financial data by project. Although there were no legal barriers, the reporting system itself was not able to disaggregate EITI-required data to a granular level. Mongolia EITI used a simple table to compare whether revenues were levied/imposed on a company or project level, and whether the reporting system was able to disaggregate at the necessary level:

3. Documenting the findings on how revenues should be reported

The MSG is advised to document the findings of its review of how the various payments and revenue streams are levied. Building on the “definition template” suggested under step 1 above, a practical approach could be for the MSG to document the following explanation in order to clarify which payments should be disaggregated by project vs company:

“Where payments are attributed to a specific project – [list the payment types levied by project] - then the total amounts per type of payments shall be disaggregated by project. Where payments are levied at an entity level rather than at a project level – [list the payment types levied by company] – the payments will be disclosed at an entity level rather than at a project level.”

Step 3: Identifying who should report what

In accordance with the EITI Standard, all oil, gas and mining companies that make material payments to a government entity, including state-owned enterprises (SOEs) are required to disclose their payments. This principle is retained also in project level reporting. However, in arrangements which involve multiple parties it might be necessary to identify what kind of payments are effectuated by the different parties to the contract. It might also be necessary to look at the payments effectuated by different companies or received by different government bodies, including SOEs. MSGs are therefore advised to consider the following questions:

1. Are there projects involving multiple companies/participants common in your country? If so, who makes the payments to the government?

Given the risks and costs associated in particular with upstream oil and gas projects, agreements are often entered into by several companies which act together in a consortium or joint venture. These joint ventures may be incorporated as a new company, in which they report as all other companies under step 1 and 2, or remain unincorporated. Unincorporated joint ventures often share risk, costs and financing through joint venture agreements (JVA) or joint operating agreements (JOA) and typically designate an operating company or “operator” which manages most joint administrative and operational tasks on behalf of all the participants.

According to Requirement 4.7, it is the legal agreement which forms the basis for the payments that matter. Where they exist, JVAs or JOAs determine which entity(ies) is/are responsible for making payments to the government.

In most cases, the operator is responsible for making payments from a joint account on behalf of the consortium/JV as a whole, with each partner funding its pro rata share of such payments by means of “cash calls” (contributions to the joint account) managed by the operator. As an exception to this practice, taxes tend to be levied on and paid by each individual participant. If necessary, the operator may settle the individual accounts of the various participants subsequently within the consortium/JV. In such cases, for the purpose of EITI reporting, the operator should disclose the payments it makes to the government on behalf of the consortium/JV, with other parties disclosing only taxes levied directly on them.

In other countries, (francophone Africa, for example), all participants in a contract are responsible for their respective shares of payment liabilities and each make their payments to the government directly. In these cases, for the purposes of EITI reporting, each participant discloses all their payments. I.e. the operator could disclose only its own share of the payments and taxes. Other parties would each disclose both their respective pro rata shares of the payments and taxes imposed on the consortium/JV and any taxes imposed directly on themselves.

Government entities report the total revenues received for the project in accordance with how these revenues are recorded in their systems.

In Indonesia, oil and gas operators report on details for various Production Sharing Contracts (PSCs) pertaining to different fields/blocks. They also include information regarding the different participants, each with their corresponding participating interest share. The reporting templates available on their websites provide disaggregated data by operator and by block for non-tax payments levied on projects through the respective PSCs (these non-tax revenues include production share, royalties, domestic market obligations and more). Tax payments are made by each individual participating company and are therefore reported by each party to a PSC, per PSCHideIndonesia EITI (2018), ‘2016 Indonesia EITI Report’, annex 1 and 2. . In Trinidad and Tobago, the operators are responsible for paying a profit share and other payments on behalf of itself and other parties in the PSC to the Ministry of Energy and Energy Industries (MEEI). However, if MEEI participates in the PSC, the ministry is …

“[…] responsible under the PSC for payment, […] out of the Government’s Share of Profit Petroleum, of the Contractor’s liability for Royalty, Petroleum Impost, Petroleum Profits Tax, Supplemental Petroleum Tax, Petroleum Production Levy, Green Fund Levy, Unemployment Levy and any other taxes or impositions whatsoever measured upon income or profits arising directly from the operationsHideTrinidad and Tobago (2018), ‘2015-2016 Trinidad and Tobago EITI Report’, page 91. .”

This means that all payment liabilities levied on companies for these projects are voided, while the only payment obligation levied on projects is the Government’s Share of Profit Petroleum, less the payments made by MEEI on behalf of the companies.

In Kazakhstan, some PSAs are still in use as the governing instrument for petroleum projects. One of the largest is Tengizchevroil LLP, an incorporated joint venture which, according to Kazakhstan’s 2017 EITI ReportHideKazakhstan EITI (2018), ‘ 2017 Kazakhstan EITI Report’, pages 71-72. , is owned by Chevron, ExxonMobil, KazMunaiGas and LukArko. As it is an incorporated joint venture, operated by Tengizchevroil LLP, the operator has its own taxpayer ID number and would be treated as a single company under a PSA for the purposes of EITI reporting.

Incorporated joint ventures such as this example are treated as any other company in EITI reporting. In other instances, the government may require the parties to regulate their activities through a joint operating agreement without incorporating a specific legal entity. Such arrangements are typically considered unincorporated joint ventures.

Company reporting examples: Operator and proportionate reporting of production entitlements by BP and Equinor

BP’s 2018 Payments to governments report discloses government production entitlements in their entirety for all partners in the joint venture for each production-sharing agreement (PSA). Equinor’s 2018 payments to governments reportHideEquinor (2019), ‘Equinor annual report 2018’ (p. 273) includes its proportionate production entitlements payment when it is not the operator of the joint venture since “size of such entitlements can in some cases constitute the most significant payments to governments”.

2. Does a state-owned enterprise operate in your country? If so, what role do they play and how do they disaggregate payments and/or receipts?

State-owned enterprises (SOEs) often represent important institutions in the extractive sector of EITI implementing countries. Although less common or dominant in the mining sector, they may still play an important role by owning and operating projects, or through their participation in joint ventures.

The EITI requires that the multi-stakeholder group ensures that the reporting process comprehensively addresses the role of SOEs, including material payments to SOEs from oil, gas and mining companies, and transfers between SOEs and other government agenciesHideEITI (2019), ‘Guidance note 18 SOE participation in EITI reporting’. . Where SOEs operate alone, they are subject to the same reporting requirements as private companies.

Where the state sells its share of production or collects other material revenues in-kind, the government, including state-owned enterprises, are required to disclose the volumes received and sold, and revenues received relating to that production and to publish data disaggregated by individual buying companyHideEITI (2019), ‘Guidance note 26 Reporting on first trades in oil’. (Requirement 4.2). Requirement 4.2 states that “published data must be disaggregated by individual buying company and to levels commensurate with the reporting of other payments and revenue streams (4.7).” Payments and other disclosures related to the sale of the state’s share of production or other revenues collected in kind must therefore also be disaggregated by sales contract or agreement (i.e. the legal agreements that give rise to payments made by buying companies). In practice, with a long-term sales contract (i.e. over multiple years), implementing countries should disclose the volume of the commodity sold and any payments received in relation to that contract. Where there are multiple contracts (e.g. different sales contracts related to different grades of oil from different fields), this information would need to be disaggregated. The MSG is also expected to consider whether to break down the information further by individual sale, type of product and price, in consultation with buying companies.

Regardless of whether an SOE is considered a payer, a revenue collector, or both, disclosures by SOEs must be disaggregated by project if the payment type is levied by project.

Sometimes SOEs act as a fiscal agent by collecting revenue on behalf of governments. In the Republic of the Congo, the state-owned enterprise receives in-kind payments from private companies on behalf of the state, which it is responsible for marketing. In this instance, once companies’ payments are reported per project, the government’s share will also implicitly be disaggregated by project.

Other times, SOEs may play similar roles as private companies by making payments to governments in accordance with their participation in various projects. In Ghana for example, Ghana National Petroleum Corporation (GNPC) participates in multiple petroleum projects lifting barrels of oil for the payment of carried and participating interests, as well as royalties. The operator and other partners are liable the remaining cash payments (tax and non-tax payments). In Ghana’s 2016 EITI Report, payments for carried interests, participating interests and royalties are all reported separately by GNPC for the Jubilee field, including disaggregation between oil and gas.

Consistent with project-level reporting, GNPC also discloses sales of oil liftings to buying companies from the Jubilee and TEN fields in a commodity trading pilot report. The data is available in open data format, and disaggregated by oil lifting rounds in 2015-2017.

Step : Agreeing a reporting framework and templates

Once the MSG has applied the definition of project (step 1), analysed which payments should be disaggregated at project vs entity level (step 2), and which reporting entities should report which payment (step 3), the MSG is advised to consider whether existing disclosures by government agencies and companies meet the EITI Requirement, and opportunities for incorporating project-level reporting through government and company disclosures (i.e. annual reports, websites and open data portals). Where systematic disclosures by governments, SOEs and companies are not sufficiently disaggregated by project based on the answers to the questions in steps 1-3, the MSG should ensure EITI reporting templates are designed to enable project-level reporting of financial data.

In April 2019, the EITI Board approved the Summary data template 2.0, to enable collection of project-level data for all EITI countries. MSGs are advised to design reporting templates equivalent to the tables in Part 5 of summary data templates or draw on the model reporting templates in excel provided by the EITI International Secretariat.

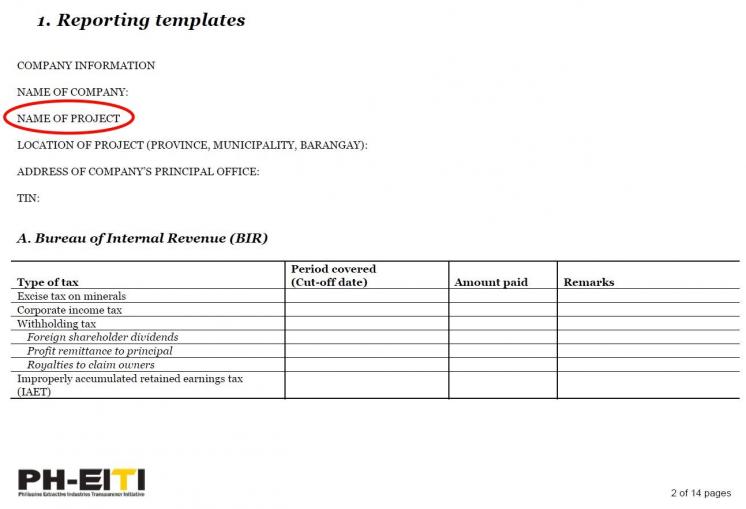

The Philippines uses reporting templates which they specifically ask to be filled out per project. This is a simple solution to ensure that existing reporting reporting templates capture project-level data. It is important that changes to reporting templates requiring project-level reporting are communicated explicitly through capacity building and training for reporting entities to avoid misunderstandings (e.g. only reporting by company).

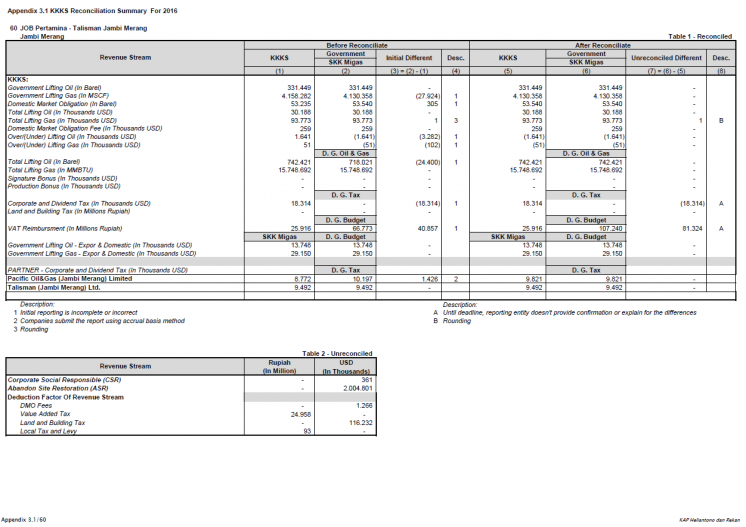

Indonesia requires operators of a project to disclose operational and financial information relevant to a project (see example under step 3). As an example of reporting, we present the reporting template below where the operator, “JOB Pertamina Talisman Jambi Merang” reports multiple payments for a project. Partners that are non-operators, such as Pacific Oil & Gas Ltd and Talisman Ltd, are only required to report on their tax obligations to the government:

Further resources

Mandatory disclosures under EU/EEA and Canada’s ESTMA

The 27 European Union member states, Norway and Canada, have introduced legislation requiring certain oil, gas and mining entities incorporated or listed in their jurisdictions to disclose payments to governments by payee and by project in the countries where they operate. While similar, it is noteworthy that project-level reporting under EU and Canada’s ESTMA is different from EITI as data are based on the operations of the entity listed or incorporated in Europe and Canada. EITI also requires that government agencies report on the revenues collected, meaning that, in order to be readily comparable, the level of disaggregation and understanding of projects must to be the same for companies and government agencies. While entities’ financial year may be different to those of governments, it is possible that the mandatory disclosures by such entities will satisfy the company reporting requirements under EITI, depending on the MSG’s approach to project-level reporting. The alignment of the definition of “project” in the 2019 EITI Standard with the existing mandatory disclosure requirements in the EU and Canada seeks to ensure that the information is consistent and comparable across jurisdictions.

The European Union Accounting Directive’s corporate disclosure rules were due to be transposed into national legislation by 20 July 2015 and all EU member countries and EEA signatories have taken various actions to do so. Article 6 of the EU Transparency Directive extended the reporting obligations in the Accounting Directive to all relevant companies whose securities are publicly listed on EU regulated stock markets, regardless of whether they are incorporated in the EU. All countries have now transposed these reporting requirements into their national laws and present multiple examples of corporate filings under the EU Accounting and Transparency Directive.

- Corporate filings for UK incorporated companies under the UK legislation are available on Companies House extractives service which are accessible here.

- Guidance for the Companies House extractives service can be found here.

- Companies listed on the main market of the London Stock Exchange, but not incorporated in the EU, must file their reports according to the Financial Conduct Authority’s Disclosure Guidance and Transparency Rules (DTR) 4.3A here and make an announcement to the UK’s National Storage Mechanism (NSM) here.

Canada's Extractive Sector Transparency Measures Act (ESTMA) has contributed significantly to global efforts to increase transparency in the extractive sector. Since the ESTMA came into force in 2015, more than 1,500 ESTMA reports with project-level disclosure have been published online. These reports, containing payments in 130 countries totalling over USD 330 billion, are a valuable source of information to view existing practices of companies reporting by project.

- Information and guidance regarding company disclosures under ESTMA.

- Links to ESTMA filings.

- ESTMA reporting templates (excel).

- UK Extractives Service (XML schema) according to EU Directive.

In order to improve accessibility, the Natural Resource Governance Institue maintains a database of Payments to Governments reports submitted by companies under EU/EEA and Canadian legislation. The information is converted into open data and is available at https://resourceprojects.org/

Related content