How can data on mining project payments benefit Ghana's citizens?

Gold mining is a major source of government revenue in Ghana. How can those impacted by the sector use data on payments made to the government to better understand the revenues the sector generates? And how can this data be used to enhance accountability?

Most of the multinational gold companies operating in Ghana are required to disclose the payments they make to government entities under Canada’s Extractive Sector Transparency Measures Act (ESTMA). Under ESTMA, which came into force in 2015, companies are required to list the specific government entities they have paid, and which projects (i.e. mines) these payments are attributable to.

Similar mandatory disclosure laws are in force in the EU and Norway, while companies listed on U.S. stock exchanges will also be required to disclose under Section 1504 of the Dodd-Frank Act of 2010, once this law is implemented. These newly-released reports provide timely information on the payments mining and oil and gas companies make to government entities.

Further disclosures lay ahead: from the end of 2018, multi-stakeholder groups in all 51 Extractive Industries Transparency Initiative (EITI) implementing countries (of which Ghana) will be required to adopt their own project-level reporting framework following the EITI global board’s 2017 reaffirmation of reporting requirements in this area.

Ghana’s Gold Mining Revenues: An Analysis of Company Disclosures, a briefing from Natural Resource Governance Institute, explores how this project-level data can be used by government, civil society organisations, media and oversight actors. It highlights several benefits and uses of project-level data.

For government stakeholders, this data aids fiscal regime monitoring capabilities, allowing specific extractive sector ministries and supreme audit institutions to figure out whether companies are making payments expected under the fiscal regime.

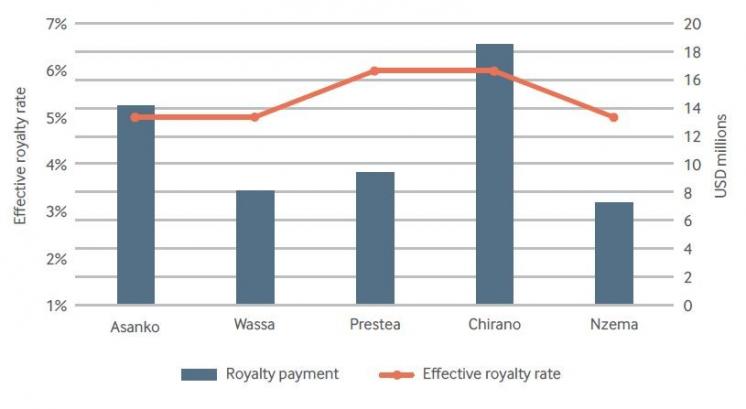

Figure 1. Estimating the effective royalty rate paid for Ghana gold mines in 2017

For example, Figure 1 shows the royalty rate paid on five gold mining projects in Ghana. The Asanko, Wassa and Nzema projects pay an effective royalty rate of 5 percent, as would be expected under the fiscal regime in Ghana. The Chirano and Prestea mines pay at an effective royalty rate slightly above 5 percent due to their location in a forestry reserve area. Companies located in forestry reserve areas are required to pay an additional 0.6 percent royalty directly to the Ghana Forestry Commission.

Civil society and media can use project-level data to check whether subnational government entities in areas affected by mining receive their fair share of revenues.

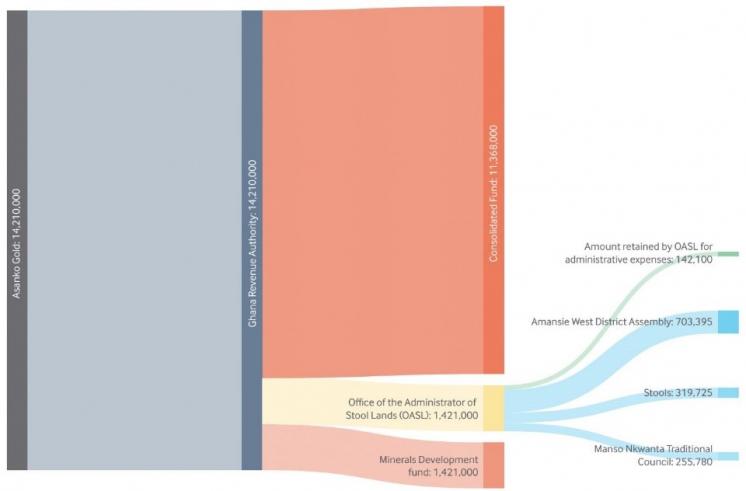

Figure 2. Asanko mine 2017 royalty payment disbursement estimation

Many resource-rich countries have formulas setting out how the revenues are distributed based on where the extractive project is located. A government’s disbursement formula and the project-level data can help estimate how much specific local subnational entities should receive. For example, it is possible to estimate how much the Amansie West District Assembly (USD 703,309) and Manso Nkwanta Traditional Council (USD 255,780) should receive of the royalties paid by Asanko Gold to the Ghana Revenue Authority for the Asanko mine in 2017.

Extractive projects can have severe adverse impacts on local infrastructure. Project-level data can help companies evidence the payments they make to offset negative impacts and communicate around them. Companies reporting under mandatory disclosure laws are required to disclose any payments they make to government entities in the countries in which they operate, including payments for local infrastructure improvement.

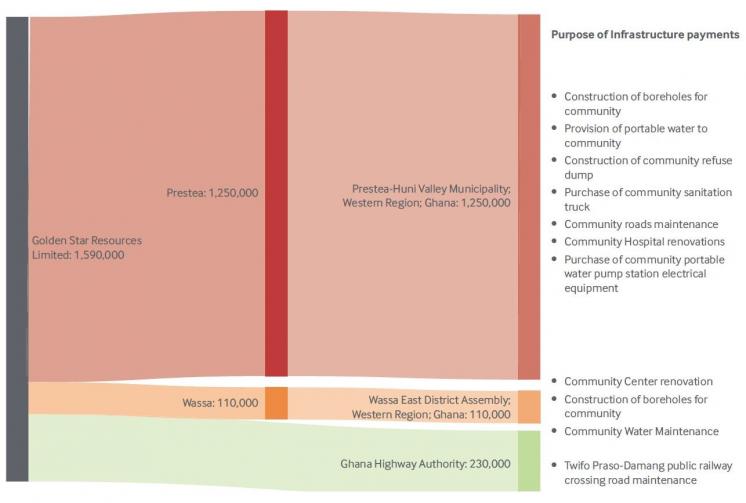

Figure 3 Golden Star Resources payments for infrastructure improvements in 2016

Figure 3 shows the payments Golden Star Resources has disclosed for infrastructure to subnational government entities close to both its Wassa and Prestea gold mines and to the Ghana Highway Authority. In its 2016 ESTMA report, the company detailed in the notes section of the report what the infrastructure payments were for, with specificity. For example, the company noted that a USD 230,000 payment to the Ghana Highway Authority was for “Twifo Praso-Damang public railway crossing road maintenance.”

Local communities in these extractive-affected areas can use these disclosures to assess whether extractive companies are making payments that are not only sufficiently reimbursing local areas for the damage caused by extractive activities, but that also benefit the local community.

Currently, only companies listed or incorporated in the EU, Canada or Norway are required to release payments-to-governments reports. However, under EITI requirement 4.7, all companies operating in EITI countries will shortly be required to report their payments at the project-level. This new project-level payment information provides an opportunity for citizens in EITI countries to better understand and maximise the benefits they receive for the extractive activities in their country.

Alexander Malden is a governance associate at NRGI, where he works on the NRGI’s campaign for commodities trading transparency and on the analysis of mandatory payment disclosure data. Edna Osei is an Africa associate at NRGI, supporting activities across NRGI’s sub-Saharan Africa portfolio, with particular emphasis on Ghana.

Contenido relacionado