Summary

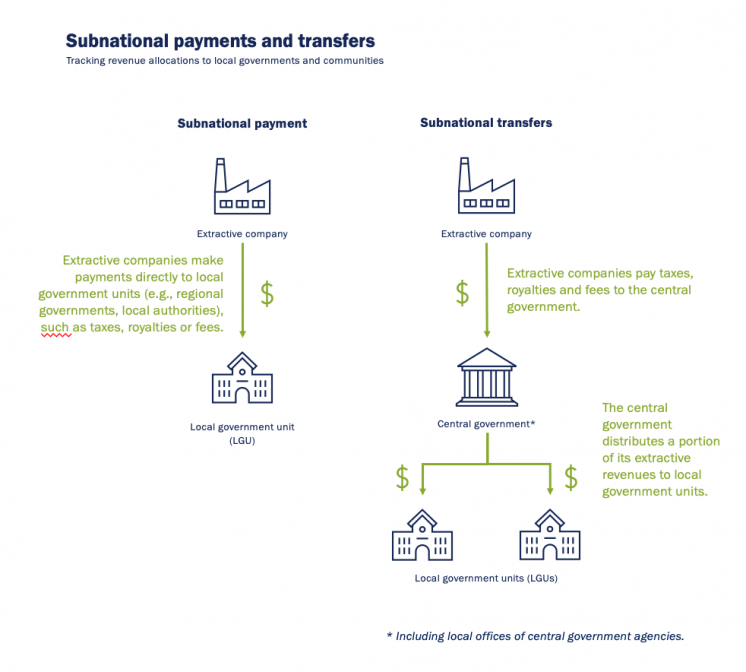

In some countries, extractive companies make direct payments to subnational government entities, such as regional governments, municipalities and chiefdoms. Some governments also have revenue sharing mechanisms that stipulate that a share of revenues collected by the central government is transferred to subnational government entities. While these payments may represent only a portion of revenues at the national level, they are often an important source of income for local governments. Transparency regarding these payments and transfers can be useful in holding local authorities to account.

EITI implementation has shown strong demand from local communities to increase transparency around the allocation of such revenues, to ensure that revenues contribute to sustainable local development. In several countries, EITI reporting has led to changes in the applicable regulatory framework and helped local communities demand the share of revenues they are entitled to. EITI implementation can also help local governments track, manage and disclose revenues more efficiently.

This note provides guidance to multi-stakeholder groups (MSGs) on how to report on subnational payments and transfers, offers examples from implementing countries and outlines opportunities to strengthen the use of data. It has two parts. Part 1 provides guidance on direct payments by companies to subnational entities. The EITI Standard requires that, where these are material, direct company payments to subnational government entities and the receipt of these payments are disclosed and reconciled (Requirement 4.6). Part 2 provides guidance on transfers of revenues between central and subnational levels of government. Where transfers between national and subnational government entities are mandated by a national constitution, statute or other revenue sharing mechanism, material transfers must be disclosed in the EITI Report (Requirement 5.2).

-

What revenues can local communities expect to receive from extractive companies based?

-

What is the effective contribution of extractive companies in local taxes and fees?

-

How are local authorities managing revenues from extractive companies? Are such revenues earmarked to specific projects and contributing to local development? How are the revenues spent?

-

How can the allocation and management of revenues from extractive resources be improved? Are there any bottlenecks in the process? If yes, how might these be addressed?

Overview of steps: Requirement 4.6

|

Steps |

key considerations |

examples |

|---|---|---|

|

Step 1: |

|

|

|

Step 2: |

|

|

|

Step 3: |

|

|

|

Step 4: |

|

How to implement Requirement 4.6

Step 1: Identify whether payments should be made by extractive companies directly to local government units (LGUs)

The MSG should first identify whether payments should be made by extractive companies directly to LGUs, based on the law, the regulatory framework or contractual provisions. While such revenue streams can be applicable only to extractive companies, they do not have to be specific to the extractive sector. Typical examples can include property taxes, surface/land fees and fees for water usage.

In identifying which revenue streams are relevant, the MSG should identify which LGUs collect these payments. Depending on the national context, payments could be received by states, provinces, regions, municipalities, districts, chiefdoms or other forms of local authority. Where it exists, the MSG should also identify the central government agency responsible for monitoring such payments. This agency can support the MSG in better understanding the applicable revenue streams. Where the MSG concludes that no such payments exist, its approach must be documented (e.g. in MSG meeting minutes, EITI reporting or other disclosures).

Democratic Republic of the Congo: Allocation of shares of mining royalties

The 2018 Mining Code introduced a new system for the allocation of shares of mining royalties at the local level (Art. 242). Extractive companies are required to make payments as follows:

- 50% to the central government;

- 25% to an account identified by the provincial authorities where the extractive company’s operations are located;

- 15% to an account identified by the authorities of the decentralised territorial entity (entité territoriale décentralisée, ETD) which has jurisdiction over the area where operations are located;

- 10% to the Mining Fund for future generations.

This distribution of revenues represents a departure from the previous mechanism, where the central government was required to transfer shares to local governments. Several projects led by the EITI and civil society organisations in the DRC aim to shed light on this new system, to identify the challenges in determining which territories are eligible, and to ensure that these large sums are managed responsibly and transparently by local authorities.

See: ITIE-RDC (2019), Rapport Contextuel ITIE-RDC 2017-2018, pp. 80-86; Makuta Ya Congo (2020), Rapport sur les redevances minières and Interactive online map.

Step 2: Identify existing disclosures on subnational payments, and determine the significance of these payments

Where the MSG has determined that extractive companies must make payments directly to LGUs, the MSG should next identify existing government and company disclosures on such payments, so as to determine whether payments were effectively made. This information is often available in annual reports, websites or data portals managed by the relevant LGUs or ministry, or in companies’ sustainability reports. In reviewing this information, the MSG should assess its comprehensiveness, timeliness, reliability and level of disaggregation.

Next, the MSG should determine whether the payments made in the period under review are considered material and should be disclosed accordingly. This should be undertaken in accordance with the approach outlined under Requirement 4.1.b on selecting appropriate materiality thresholds. When considering appropriate materiality thresholds, the MSG may wish to take into account the importance of these revenue streams for stakeholders and local communities.

Where the MSG concludes that such payments were not material, its approach must be documented.

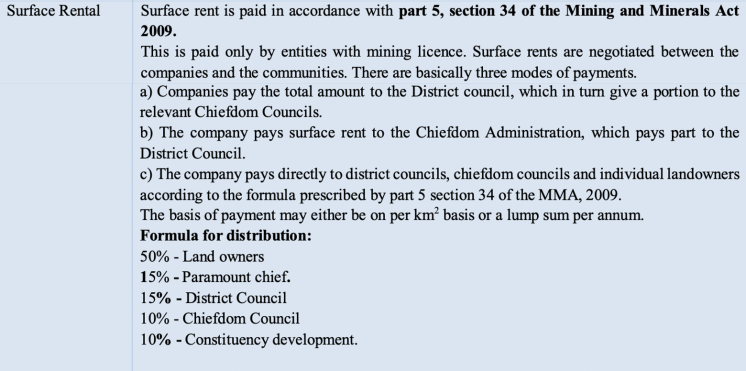

Sierra Leone: Payments of surface rents to local beneficiaries

Sierra Leone’s 2017-2018 EITI Report included data on surface rents paid by three mining companies to land owners, paramount chiefs, district councils, chiefdom councils and constituency development funds. For example, disclosures show that one company, Sierra Rutile Ltd, paid around USD 507,000 to fifteen beneficiaries.

The report clarified that surface rents are negotiated between the companies and the communities. Payment are made either based on surface area or as a lump sum per annum. They are then disbursed to LGUs in accordance with Part 5, Section 34 of the 2009 Mining and Minerals. The Sierra Leone (SLEITI) online mapping tool discloses relevant data, such as the chiefdom and district boundaries as of 2017.

Following dissemination activities led by SLEITI in 2020, stakeholders from six mining communities demanded greater transparency in the collection and use of mining revenues generated from operations in their communities.

Step 3: Disclose disaggregated, timely and reliable data on subnational payments

Data on subnational payments should be disaggregated by extractive company and by LGU. Where there are gaps in data routinely disclosed by government and corporate systems, the MSG should agree a data collection and publication procedure that ensures that comprehensive, disaggregated, timely and reliable data on subnational payments is publicly available.

Where the MSG reconciles payments made by extractive companies and revenues collected by LGUs, practical challenges in associating LGUs to the data collection process should be taken into consideration. The MSG should consider disclosing the data in a way that addresses information needs of different genders and subgroups of citizens.

The MSG should document this approach. The MSG may also wish to task its technical team, a relevant government entity or an independent consultant with developing templates for reporting on subnational payments.

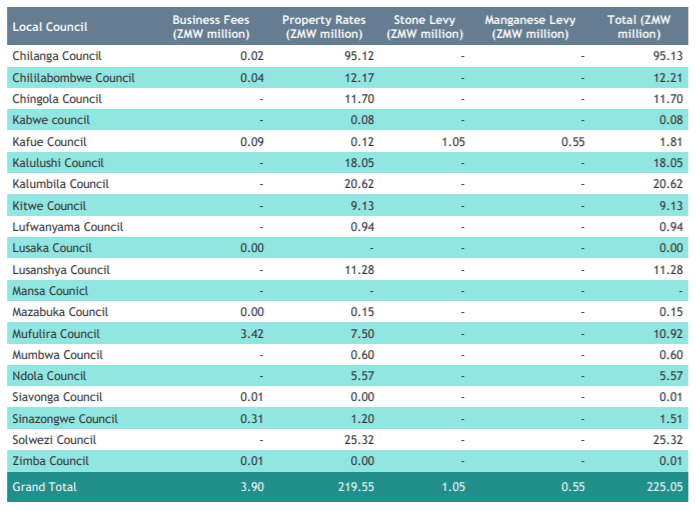

Zambia: Annual business fees and property rates paid to local councils and authorities

In preparing Zambia’s 2018 EITI Report, the MSG agreed to disclose and reconcile annual business fees and property rates given their importance to the areas served by a local council. Stakeholders from Solwezi, a town located in Zambia’s mineral-rich North-Western Province, used EITI data to advocate that 10% of direct payments from mining companies should be earmarked toward social service expenditures. Since then, a by-law has been passed providing for these direct payments. Similar discussions are taking place in other communities, such as Mufulira.

Step 4: Review and analyse disclosures

Based on a review of existing disclosures, the MSG could agree recommendations for the MSG or other stakeholders to addressHideFurther guidance on developing recommendations from EITI reporting available here.. These could include:

- If the MSG has agreed work plan objectives related to social development and contributions to local communities, the MSG could consider how the disclosures could be used to help meet these objectives.

-

The MSG could formulate recommendations to strengthen reporting on subnational payments by government and corporate systems, including the timeliness of reporting to ensure that local communities are aware of taxes levied by LGUs.

- The MSG could reflect on how to engage the central government in monitoring subnational payments.

- The MSG could agree on how to use disclosures on subnational revenues to inform debates on how extractive revenues are managed and used at the local level.

Overview of steps: Requirement 5.2

|

steps |

key considerations |

examples |

|---|---|---|

|

Step 1: |

|

|

|

Step 2: |

|

|

|

Step 3: |

|

|

|

Step 4: |

|

|

|

Step 5: |

|

|

|

Step 6: |

|

|

How to implement Requirement 5.2

Colombia: The General System of Royalties (SGR)

Colombia’s Sistema General de Regalías (SGR, General royalties system) sets out extractive revenue allocations to local projects. Through the SGR, revenues were previously allocated to six thematic funds, which local governments could apply for to obtain funding for specific projects. However, the process to apply and obtain funds was complex and difficult for users to navigate. Local actors lacked an understanding of how much their respective LGUs could benefit from. Recent EITI reporting has sought to clarify the complex functioning of the SGR.

In September 2020, the government introduced a new law. With this reform, municipalities and departments will have more autonomy to manage royalty shares (totalling of USD 4.2 million). A larger portion of these revenues will be distributed to poorer regions and, for the first time, royalties will be directed to environmental protection, with 5% allocated specifically to conservations areas and fight against deforestation.

Following the introduction of this revised system, the EITI in Colombia has the opportunity to explain the key changes and support effective reporting of these revenue transfers to stakeholders and citizens.

Step 2: Identify the statutory revenue-sharing formula and calculate the amounts that should be transferred

Based on a review of the existing legal and regulatory framework, including publicly available contracts, the MSG should identify whether a statutory revenue-sharing formula for subnational transfers exists. Often, these formulas determine a percentage or share of revenues that should be transferred at to LGUs. However, some revenue-sharing formulas can be complex. They may vary across regions, for example based on the contribution of each LGU to the overall production of commodities.

Where the MSG has identified an existing revenue-sharing formula, the MSG should calculate the amounts that should be transferred to the local level for the period under review, disaggregated by LGU. The timely disclosure of such information is key for local governments to plan their budgets accordingly.

Where such a formula does not exist but transfers were made, the MSG should document how the shares are calculated by the central government. For instance, revenue transfers may be determined based on companies’ activity reports, a finance law or the government budget, or calculated on a monthly rather than annual basis.

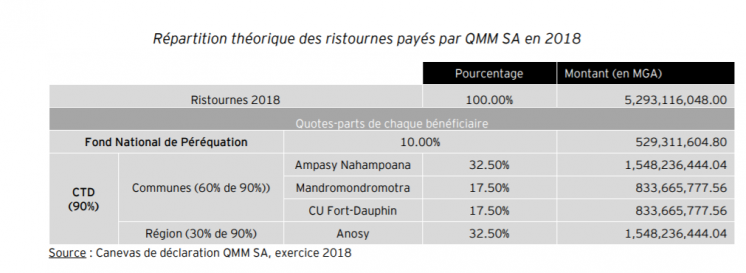

Madagascar: Transfers of shares of “ristournes”

EITI implementation in Madagascar has emphasised the importance of reporting on transfers of shares of mining revenues (“ristournes”, derived from mining royalties) at the local level, in particular for communities, or communes, affected by large mining projects. In an addendum to its 2018 EITI Report, the MSG provided the theoretical amounts that should have been transferred by the Treasury to three communes and one region affected by ilmenite producer QIT Madagascar Minerals SA (QMM SA), a subsidiary of Rio Tinto.

Step 3: Identify existing disclosures of subnational transfers, and determine the transfers’ significance

The MSG should identify existing government and company disclosures of subnational transfers. The MSG can then determine whether the central government made transfers to LGUs in accordance with the revenue-sharing formulas in the period under review. The MSG might wish to consult the Ministry of Finance, sector-specific ministries and/or the Treasury for information on existing disclosures.

The MSG should then agree on setting a reporting threshold for disclosing such data, drawing on the methodology agreed by the MSG on selecting material revenue streams (see Requirement 4.1.b). Depending on the national context and the significance of such revenues for local communities, the MSG might decide that subnational transfers should be disclosed without setting a materiality threshold. Extractive companies might also wish to know the value of revenues transferred to the LGUs where they operate. However, MSGs might wish to take into account challenges in associating LGUs to the reporting process. For example, data collection might take more time where LGUs use a paper-based accounting system or experience connectivity issues. Ensuring that stakeholders in LGUs have a good understanding of the EITI process and can participate often require significant resources.

Papua New Guinea: Oil and gas royalties and development levies

In a scoping study on subnational payments and transfers in PNG’s extractive sector, the majority of stakeholders consulted agreed that all subnational payments and transfers should be disclosed without setting a materiality threshold. They argued that “Regardless of the amount, people want to know what is happening with [those public funds].” The report drew from the PNG EITI’s methodology for setting materiality thresholds for revenue streams to set out recommendations for subnational revenues, recommending the following criteria:

- Quantitative materiality for subnational reporting set at K20,000 for provincial government entities and K50,000 for non-government entities;

- Qualitative materiality is defined as “those subnational revenue/payment streams that are considered important or potentially important to subnational stakeholders and citizens” (…)”.

Step 4: Disclose transfers from national government entities to LGUs and identify discrepancies

Once the MSG has identified the amounts that should have been transferred based on the revenue-sharing formula, it should disclose the amounts that were effectively transferred. The MSG should then identify any discrepancies between statutory shares and effective transfers, disaggregated by LGU.

This data should be disclosed in a timely manner and consider the information needs of different genders and subgroups of citizens. This information can help local public officials and communities understand whether they are receiving the revenues they are entitled to. This can further enable them to hold the central government to account should there be any discrepancies.

Where discrepancies are identified, MSGs might wish to identify the reasons underlying these discrepancies and formulate recommendations to address them (see Steps 5 and 6).

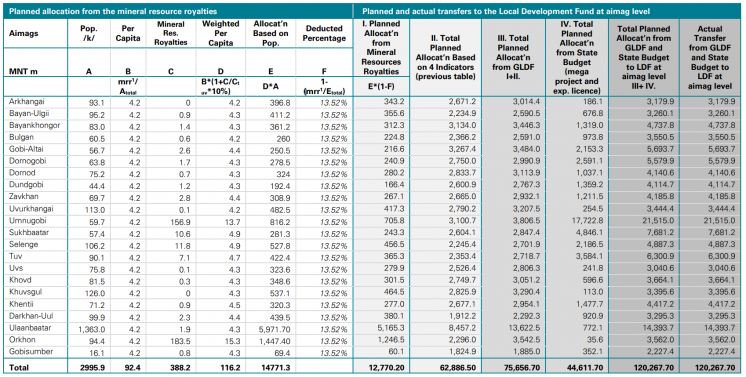

Mongolia: Allocations to the Local Development Fund

Mongolia’s General Local Development Fund (GLDF) consists of shares of VAT of goods and services, mineral resource royalties, oil resource royalties, and grants and donations. Shares of the GLDF are transferred to 21 provincial governments, or aimags, via their Local Development Fund (LDF).

EITI reporting has sought to clarify the parameters used to calculate the revenue-sharing formula for each subnational transfer, including local development index, population and tax coverage index. Mongolia’s 2016 EITI Report included calculations for planned subnational transfers for each aimag. It revealed that there were no discrepancies between planned revenues and actual transfers to the aimags’ LDFs.

Step 5: Review information on subnational transfers, focused on data reliability and discrepancies

By checking whether declaring entities adhere to the MSG’s agreed procedure for data quality assurance, the MSG can provide an assessment of the reliability of disclosures. Several mechanisms are possible depending on the national context and the existing system for subnational transfers. For instance, the MSG could check what auditing practices apply to transactions made by the Treasury, where the latter is responsible for effectuating transfers to LGUs.

Where possible, the MSG might wish to reconcile data disclosed by the central government agencies with data disclosed by LGUs, to identify any discrepancies. This methodology can help understand practical challenges related to the timeliness of transfers, e.g. absence of adequate bank accounts for local governments to receive revenues, lengthy procedures to see them approved at the central level, or revenues paid out in subsequent years. The MSG might wish to formulate recommendations to address such disclosure gaps and practical obstacles.

Where there are constitutional or practical barriers that hinder the participation of LGUs, the MSG could consider seeking adapted implementation in accordance with Section 4, Article 1 of the EITI Standard.

Mali: Transfers of shares of “patentes” in mining communities

In Mali, companies in all sectors must pay patentes, a share of which are then transferred at the local level. Payments from mining companies make up a significant amount of total patentes at the local level. The Mali EITI made it a priority to disclose detailed information about these transfers to mining regions, given considerable public interest and the significance of this revenue stream for local governments’ budget.

In addition to highlighting the discrepancy between statutory shares and effective transfers in its 2016 EITI Report, Mali attempted to reconcile this data with revenues received as reported by local municipalities. The report identified challenges in reconciliation and outlined concrete recommendations to improve reporting by LGUs going forward. The report noted that the patentes paid by mining companies and subcontractors make up the majority of local authorities’ revenues.

Burkina Faso: Local mining development funds in mining communities

To centralise the collection and transfer of extractive revenues to local communities, Burkina Faso’s government established a fund (Fonds Minier de Développement Local) intended to finance regional and local development plans. The fund collects a 1% share of monthly revenues from mining companies and 20% of the royalties collected by government.

Burkina Faso’s 2019 EITI Report highlights discrepancies between the revenues that were owed and paid. It also documents several legal disputes between the government and companies that had not transferred expected shares in accordance with a 2017 decree.

In June 2020, Burkina Faso’s Court of Auditors published a report to ascertain whether the funds were properly allocated and managed. It identified weaknesses in the revenue sharing mechanism and provided a number of recommendations to improve the management of mining revenues owed to regional and local authorities. EITI reporting has helped to shed light on issues related to the fund, and has subsequently informed national media and public debate.

Step 6: Where possible, report on how earmarked revenues are managed and disbursed

Beyond determining whether transfers were made at the local level were effectively made, local communities are particularly interested in information around how these revenues are used and managed. Revenues might be earmarked for specific expenditures, such as programmes or investments, depending on the regulatory framework. For example, a percentage might be allocated to developing public infrastructure, and a more limited share can be allocated to recurring operational costs on an annual basis.

Communities might wish to know whether revenues are allocated accordingly and contribute to sustainable local development. Thus, they can use this data to hold local public officials accountable for the management of extractive revenues. The MSG might wish to consult relevant stakeholders to undertake additional analysis and formulate recommendations to improve revenue-sharing mechanisms.

Nigeria: Community perceptions of subnational revenue allocations

The Constitution of Nigeria assigns 13% of oil revenues to derivation funds for the benefit of oil producing regions. Nigeria EITI conducted a study to examine how revenue allocations were perceived by local communities in the oil producing states of Delta, Imo and Ondo, specifically in terms of their impact on local development.

The study revealed that communities found these revenues to be opaque, which prevented them from holding their local governments to account. They also indicated that there was a top-down approach to community development, governance deficits in development commissions, and an absence of sustainability plans for projects. The study issued a set of recommendations for local governments, civil society and communities.

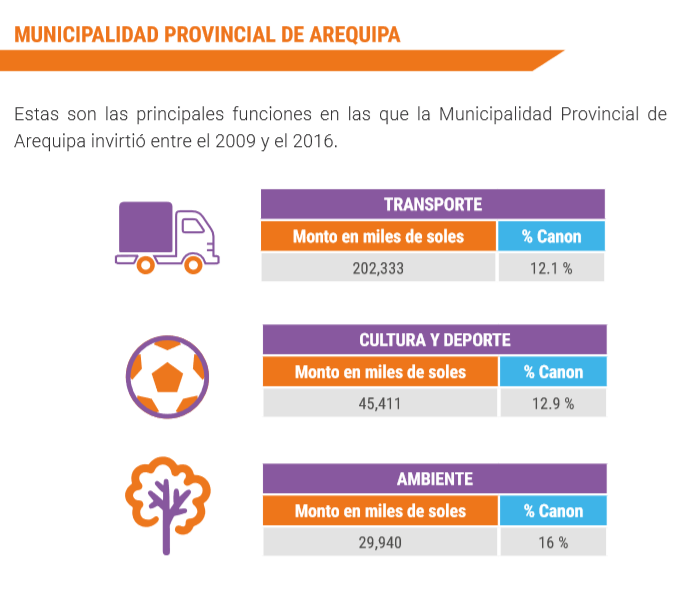

Peru: Local expenditures of subnational transfers

Following a 2004 law on fiscal decentralisation, the Government of Peru established a complex system of subnational transfers. The revenues transferred to local governments are based on intricate revenue-sharing formulas, which take into consideration production figures, population size and a “basic needs index” for each region and municipality.

Peru has established local multi-stakeholder groups in five regions, including Arequipa. In its 2016 EITI Report, the provincial government of Arequipa disclosed how much of their extractive revenue shares were invested in expenditures related to transport, culture and sports, and environment.

Further resources

- EITI International Secretariat (2020), Empowering communities in EITI implementing countries to participate in the oversight of the extractive sector

- NRGI (2018), Subnational Revenue Distribution

- NRGI (2016), It Takes a Village: Routes to Local-level Extractives Transparency

- World Bank (2011), Implementing EITI at the Subnational Level