Hit by a triple whammy of Ebola, falling commodity prices and low currency, the 2014 SLEITI report reveals the role of extractives in a challenging year

2014 marked the outbreak of the deadly Ebola epidemic that took over 3000 lives in Sierra Leone. The outbreak affected not only social and political activities but also disrupted economic activities. The effect of the Ebola outbreak was further exacerbated by the 22% fall in the Sierra Leonean currency against the US dollar and a decline in commodity prices – iron ore price fell by more than half from USD 140 per metric tonne in March 2013 to less than USD 70 in December 2014. Sierra Leone’s GDP growth declined substantially from 21% in 2013 to -21% in 2015.

According to the latest Sierra Leone EITI Report, the extractive sector remained the key driver of growth. The 2014 report, which was published in December 2016, disclosed information on the sector’s contribution to the economy, relevant legal and fiscal framework, license allocation, production and revenue data.

Declining revenue in a challenging year

The 2014 SLEITI Report, which covers the oil, gas (exploration) and mining sectors, shows a 22% decline in government revenue from the extractive sector compared to previous year. Totalling around USD 58 million, revenue from the extractives contributed 20% of GDP. The mining sector represented 85% of total receipts from the sector, whilst the oil and gas sector represented 15%. Mineral royalty, mainly from iron ore, remained the highest contributor at 57% of total revenue from the extractive sector.

Image: Comparing EITI reconciled revenue streams for mining in 2013 and 2014, from the 2014 SLEITI Report.

Towards a structural economic shift?

Beyond the figures lies an emerging trend. Despite diminishing revenue, the report suggests a structural shift towards the extractive sector in the coming years. The extractive sector has increased considerably from 4% of GDP in 2010 to 20% in 2014. With the end of the Ebola outbreak and an improvement in commodity prices, the report notes that exploration activities are expected to bounce back. The World Bank projects a 12.8% GDP growth by 2017 with the extractive sector remaining significant in achieving this growth.

Tracking payments to local communities

The report also highlights disclosure of direct payments to local authorities for development. According to the Sierra Leonean Mines and Minerals Act of 2009, mining companies are mandated to pay ‘surface rent’ (direct payment by companies) to owners of the land - chiefdoms and district councils. A total of USD 2.4 million was disclosed as surface rent (oil, gas and mining) in 2014. Though the amount is small, it represents over 200% increase in surface rent payment disclosure from 2013. The report recognises the lack of consistency in the payments of surface rents - some companies make payments to District Councils and the Ministry of Local Government and Rural Development for disbursement, whilst others pay directly to chiefdoms, individuals, paramount chiefs and members of parliament. The report recommends that payment of surface rents should only be managed by entities with well-functioning accounting practices.

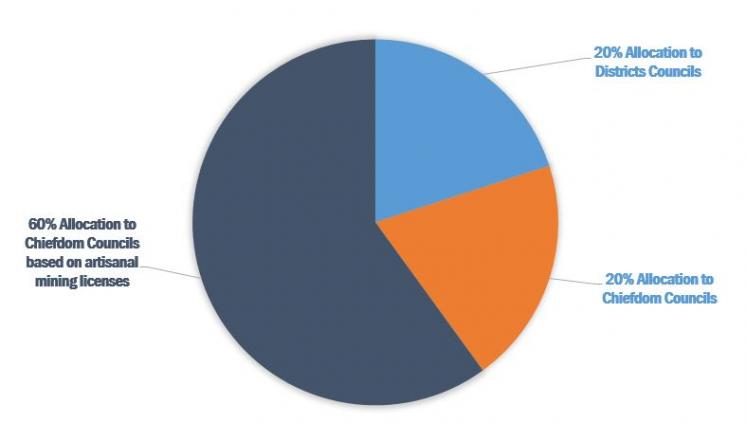

The government levies a 3% tax on the value of diamonds mined by holders of artisanal mining licenses. Sierra Leone established the Diamond Area Community Development (DACD) Fund in 2001 to support community development in mining communities. 25 % of this 3% tax is transferred to fund the DACD. This mean less than 1 % of the total value goes to mining communities. 60% of this fund goes to the chiefdom councils based on artisanal mining licences while the remaining 40% is divided equally between district councils and chiefdom councils.

Image: Percentage allocation of DACD Funds to Districts, Chiefdoms, and Chiefdom Councils based on artisanal mining licenses, from SLEITI 2014 Report.

However, payments to the DACD fund were not submitted in the 2014 Report. Moving forward, the report encourages that guidelines developed by the World Bank for the disbursement of DACD need to be implemented.

By making these subnational payments transparent, communities are better informed to hold central government, local government and companies more accountable.

- Access the full Sierra Leone EITI 2014 Report.

- Sierra Leone has also made progress on how it intends to disclose beneficial owners of extractive companies. Read the recently published SLEITI beneficial ownership roadmap.

- For more information about the EITI process in Sierra Leone, please visit the country page on eiti.org.

Related content