Togo recognised as making meaningful progress against the EITI Standard - EITI helps brings tax reforms in mining

Togo recognised as making meaningful progress against the EITI Standard - EITI helps brings tax reforms in mining

The EITI Board congratulated Togo on its achievement, noting that the EITI has brought valuable information to the public domain and improved the country’s statistics.

8 May 2018 – Togo was today assessed as having made meaningful progress in meeting the requirements of the EITI Standard. The decision was made by the EITI Board, who commended the efforts of the Government of Togo on progress made in using the EITI to enhance transparency and accountability in the country’s extractive industries.

Togo produces iron, phosphates, limestone, gravel and sand. It began EITI implementation to help address widespread social conflicts around how much of the revenue went to the communities where the resources came from.

Fredrik Reinfeldt, Chair of the EITI, said:

“EITI implementation in Togo has brought tangible improvements in the governance of the sector over the last decade. I encourage all stakeholders to use the results of this Validation to accelerate progress and use the EITI to its full potential.”

Upon receiving the news of the Board’s decision, Kokou Didier Agbemadon, National Coordinator and EITI Board member, said:

“Togo aspires to transparent and accountable governance. The EITI has greatly contributed to the improved governance of the economy through multi-stakeholder dialogue. Togo will endeavour to implement the Validation recommendations, to ensure that EITI implementation contributes to sustainable development, and dialogue that secures the trust of the people”.

According to the Validation report, the EITI has brought valuable information into the public domain and improved the country’s statistics, particularly on employment and production. EITI implementation has also accelerated tax reforms in the mining sector. The government has removed temporary identification numbers delivered to mining companies by the Customs Authority. The tax coordination office, OTR, now issues unique permanent tax identifiers to each mining company. The Board encouraged the government to enshrine transparency requirements in the new mining code, including provisions related to beneficial ownership disclosure.

Recommendations

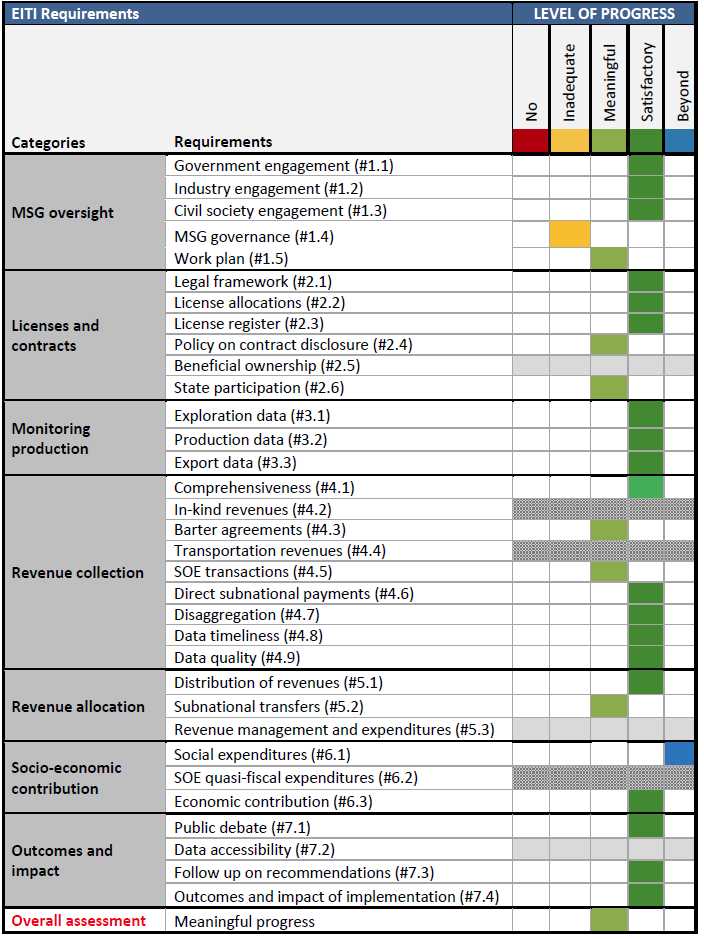

The Board noted that the EITI in Togo had gone beyond the minimum required by the EITI Standard in disclosing voluntary social expenditures (6.1). The Board also noted the government’s efforts in using the EITI to bring more transparency in the marketing of precious minerals, transportation, and groundwater exploitation. Despite challenges in the disclosure of barter agreements and state participation in the extractive sector, the EITI Board considered that Togo had made meaningful progress in achieving the broader objective of improved governance of the sector.

Togo will have 18 months, i.e. until 8 November 2019 before a second Validation to carry out corrective actions identified in the Validation report. In particular, Togo will focus on requirements relating to MSG governance (1.4), EITI workplans (1.5), contract transparency (2.4), state participation (2.6), barter agreements (4.3), SOE transactions (4.5) and subnational transfers (5.2).

Scorecard

Notes

- Validation is the EITI’s independent evaluation mechanism. It assesses countries against progress made in meeting the 2016 Standard.

- The Board decision in full, including corrective actions and impact of the EITI in the country, can be found here: eiti.org/BD/2018-24

- The reports giving an extensive review of Togo's extractive sector can be found here: eiti.org/document/togo-validation-2017

- See here for a full explanation of the various levels of progress under the EITI Standard.

- For further information about the EITI in Togo, please visit the country page on the EITI website and Togo's own EITI website.

Related content