With ten years’ experience, EITI Niger can now leverage reforms to improve the accountability of its extractives governance.

As Niger takes stock of the impact of the past decade of EITI implementation, it has the opportunity to assess whether the EITI is meeting the public’s demands for information. Rather than ever-expanding EITI Reports, there is an opportunity to open up government systems to ensure that the information most in demand is available regularly and routinely.

Leveraging audit reform

While Niger’s decade of EITI implementation has already spurred tangible public finance reforms, they are still further opportunities. Acting on one of the corrective actions from Niger’s Validation under the EITI Rules in 2010-2011, the Cour des Comptes (auditor general) initiated annual audits of the government’s extractives revenue collection, with public reports covering 2010, 2011 and 2012.

The audits made some important recommendations, including the need to roll out single tax identification numbers to all collecting agencies, stricter oversight of mining and petroleum license-holders and the need to re-examine tax exemptions for extractives companies, valued at over XOF 140 billion (USD 233m) for total extractives tax revenues of roughly XOF 75 billion (USD 125m). Yet so far only 9% of the 2010 report’s recommendations have been implemented according to the auditor general.

Although the Cour des Comptes’s annual audits were meant to provide certification for the government’s EITI disclosures, recent reports have been delayed. The publication of the 2013-2014 audit report is still pending. While operating to international standards in line with INTOSAI, the Cour des Comptes remains under-resourced with only three staff working on the annual extractives audits. The IMF’s last Public Expenditure and Financial Accountability (PEFA) review of Niger, in 2013, ranked the Cour des Comptes highly on the timeliness of audits, but poorly on adherence to auditing standards and robustness of procedures. Niger’s 2012 EITI Report was the last based on government figures audited by the Cour des Comptes. Yet the country’s EITI implementation could provide a tool for tracking changes in auditing practices and following-up recommendations, in line with requirement 4.9.

Unpaid subnational transfers

There is clearly a great demand for disclosures of subnational transfers linked to royalties. Local governments hosting extractives activities are statutorily entitled to an aggregate 15% of all mining and petroleum royalties (and other smaller revenues). Although the nation’s Treasurer is required to issue a circular defining splits in transfers between local governments on an annual basis, the Ministry of Finance has not issued such a circular since 2013, effectively halting sub-national transfers. While not the largest in value, these represent expenditures most visible to local communities in Niger, as in many other countries in the region. Yet there is little public information on subnational transfers, nor on the arrears built up in recent years. Niger’s EITI reporting provides a key channel for improving public understanding of the way in which such transfers are allocated and tracking what each local government should receive, in line with requirement 5.2.

Strengthening payment traceability

The government’s public finance reforms provide fertile ground for embedding EITI reporting in government systems. Just as the Finance Ministry’s Tax Department is working to digitise its tax collection systems, it is also rolling out single tax identification numbers. The extension to other revenue collecting agencies would allow the Treasury to start disaggregating extractives taxpayers from non-extractives contributors. The latest publicly-available tax data available has a roughly 30-month delay (data up to August 2014 is available as of February 2017), so there is also ample scope for disclosing more timely tax information.

While digitisation and unified codes for all taxpayers should improve the traceability of company payments, the introduction of a unified revenue classification in line with international standards would further improve the traceability of payments. Niger has already been producing machine-readable EITI data categorised under the IMF’s Government Finance Statistics (GFS) coding – accessible through Niger’s EITI country page. The government could draw on this classification of revenues to implement unique GFS codes for all extractives revenues.

Cadastral conundrums

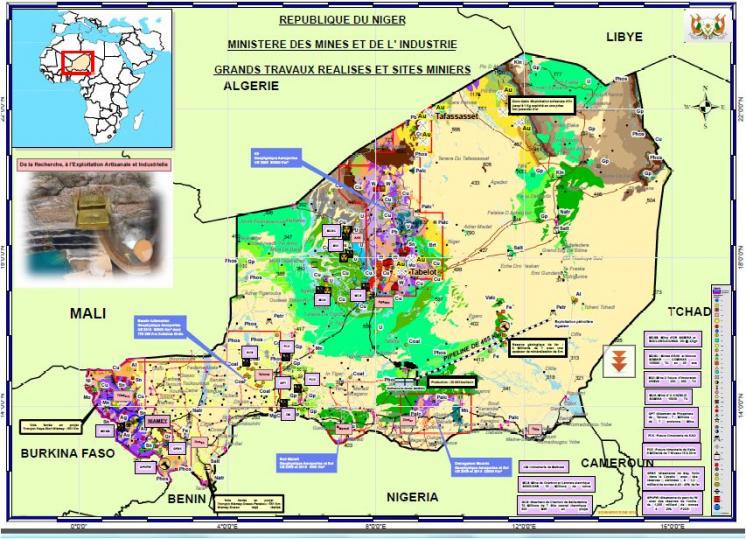

EITI Reports and limited third-party sources such as the Energy Charter provide the only publicly-available source of information on mining, oil and gas licenses. More could be done to align these with the nascent map of mining licenses available on the Ministry of Mines and Industrial Development’s website. Efforts to modernise the mining and petroleum cadastres are on-going. With these reforms still tentative – it is unclear whether the cadastres will be made publicly accessible online – EITI reporting should serve both as an annual diagnostic and as a data collection tool to plug any gaps in the current registers, in line with requirement 2.3.

Source: Ministère des Mines, République du Niger

Applying the law

Finally, the EITI could be a key channel for ensuring better implementation of laws already on the books. There are low-hanging fruit, such as the 2010 Constitution’s provisions (Article 150) requiring the publication of all extractives contracts. While all contracts are required to be published in the official gazette (Journal Officiel), which is not available online, only a limited number are public. The EITI could provide Niger with a way of tracking those contracts not yet disclosed, in line with requirement 2.4.

Having laid the groundwork for transparent reporting of revenues, Niger now faces a watershed. With far broader transparency requirements under the EITI Standard, the challenge is to render EITI information accessible while meeting the vibrant domestic demand for information. Capitalising on disparate government reporting structures, including the National Statistics Agency’s 300-page annual statistical bulletins and its open data portal, Niger now has the chance to integrate EITI reporting into government and company systems.

For more information about the EITI process in Niger, please visit the country page on eiti.org.

Связанные материалы