Resource-backed loans

Requirements 4.2 and 4.3

This note provides guidance to multi-stakeholder groups (MSGs) on the EITI's requirements on disclosing resource-backed loans.

For countries with limited access to credit and capital, resource-backed loans provide a means of raising funds for infrastructure and development projects. These loans can take the form of prepayment or advance payment deals, where governments or state-owned enterprises (SOEs) receive funds in exchange for future resource production or delivery.

However, resource-backed loans come with certain risks. Without proper public oversight, unfavourable terms and conditions can significantly impact a country's future public revenues and access to credit. The structure of these loans, including their size, the terms and the repayment schedule, can have long-term economic implications for the country.

Concerns have been raised about the nature of such loans, as they may contribute to the already high level of indebtedness in some resource-rich countries. In many cases, resource-backed loans involve higher interest rates compared to conventional market-based loans, lack transparency and are vulnerable to corruption. As a result, some of these arrangements have been scrutinised by civil society organisations and international organisations such as the IMF and the G20.

Requirement 4.2 and Requirement 4.3 of the EITI Standard require countries to disclose the terms and the value of any resource-backed loan agreements, the involved parties, as well as the volume and value of any transfers made under the agreement. This note provides EITI multi-stakeholder groups (MSGs) in EITI implementing countries with an overview of the details to be disclosed regarding resource-backed loans. It complements guidance on Requirement 4.3 on infrastructure provisions and barter arrangements, which provides guidance to implementing countries and MSGs on identifying such agreements and establishing reporting and data assurance procedures. This guidance also aligns with the EITI’s reporting guidelines for companies on their disclosures related to resource-backed loans they provide to governments and SOEs.

In 2023, Requirements 4.2 and 4.3 were expanded to support countries in enhancing their revenue collection efforts. The goal is to increase understanding of valuation of oil, gas and minerals. Under Requirement 4.2, countries are encouraged to disclose their sales agreements with buying companies. Additionally, Requirement 4.3 requires countries to consider infrastructure and barter provisions, including resource-backed loans.

Benefits of disclosing resource-backed loans

Disclosure of information on resource-backed loans has multiple benefits including:

- Promoting trust between citizens and the government;

- Improving investment attractiveness;

- Enabling greater budgetary analysis which can inform better policy and decision-making.

Overview of steps

| Steps | Key considerations |

|---|---|

|

Step 1: |

|

|

Step 2: |

|

|

Step 3: |

|

Key concepts

Defining resource-backed loans

The EITI defines resource-backed loans as agreements whereby an investor provides loans to a government in exchange for, or collateralised by, future delivery of mineral, oil or gas commodities. Such loans are to be spent on investments external to the concession, meaning that they do not contribute to project finance or carried equity. An example of this is a commodity trader that provides sovereign loans (including pre-financing agreements and resource-backed loans) in exchange for future delivery of crude oil at set terms and for a set period.

Types of agreements

The characteristics of resource-backed loans vary significantly depending on the parties involved. Some examples of resource-backed loans include:

- Resource prepayment: A loan in which repayment is made directly to the lender in kind (e.g. repaid with barrels of oil).

- Resource sales-receivable loan: A loan agreement which specifies an amount of oil to be sold to a designated buyer, with the resulting revenues being used to repay the original lender.

- Resource collateral loans: A loan which is collateralised by undeveloped resource reserves.

How to disclose data on resource-backed loans

Step 1: Define and identify resource-backed loans

The structure of resource-backed loans varies significantly. When defining and identifying resource-backed loans and determining what details to disclose, MSGs may wish to consider the following questions:

- What is the materiality and length (tenor) of the agreement? Some loans are advance payments made by companies purchasing commodities, and agreements can last anywhere between 1-2 years to 20-30 years. Occasionally, short-term operational prepayments may extend over 30 days, but such agreements are typically not considered as resource-backed loans. The size and duration of an agreement are useful parameters for determining its significance for disclosure, and the level of detail required.

- Who are the parties involved? Is the borrowing entity the government or an SOE, and who is guaranteeing the loan? Besides the borrowing entity and the lending company, other parties may include financial institutions, commodity traders and banks.

- What are the key features and the schedule of repayment? Repayment terms can vary across loan agreements and may have significant implications for a government’s payment obligations and vulnerability to commodity price fluctuations. Repayment amounts may be defined as set volumes, a percentage share of in-kind revenues or specific values.

Step 3: Disclose data on resource-backed loans

Once the MSG or reporting entity has defined resource-backed loans, identified agreements to be covered by disclosures and reviewed the lending process, it should consider the details that need to be disclosed for each material agreement. Disclosures should be divided into two stages: when an agreement is signed, and during the implementation of the agreement (including any changes to the agreement).

The MSG may want to establish a procedure to ensure data quality and assurance in the disclosure of this information in line with Requirement 4.9, for example by comparing government disclosures against company disclosures where feasible.

Stage 1: When the agreement is signed

Upon finalising and executing a resource-backed loan, the contracting parties, including the borrowing entity (either the government or the SOE), should report basic information about the agreement. The information can be summarised and made accessible through EITI reporting. The information should be updated following any renegotiation.

Required disclosures

In accordance with Requirement 4.3, the MSG should describe its understanding of the key terms of the resource-backed loans in place during the reporting period. This description aims to enable stakeholders to compare these agreements to conventional lending agreements. The details should include:

|

Parties to the agreement |

|

|

Key terms of the agreement |

|

Encouraged disclosures

|

Further details on the loan |

|

Going beyond the EITI Standard

Should the MSG wish to provide additional information that may further help achieve the objective of Requirement 4.3, it may wish to consider disclosing the following:

- Guarantor/facilitator (e.g. bank, government or other institution)

- Debt characteristics or measures specific to the loan (e.g. if the parties have previously entered into a similar agreement)

- Debt sustainability indicators (e.g. total government debt, total SOE debt and country credit rating)

- Whether applicable laws and procedures were followed in practice (e.g. date of ratification by parliament)

- Whether the loan has government guarantee and whether it is included in government debt. If not, this should be disclosed in accordance with Requirement 6.2.

- Any laws governing the agreement

- Intended purpose of the borrowed funds and/or restrictions on their use

- A description of lender selection process (e.g. if there was a tender)

- Legal remedies in the event of default

Stage 2: Periodic updates during the implementation of the agreement

Throughout the agreement’s duration, the contracting parties should report on its implementation, for example on an annual basis.

Required disclosures

In accordance with Requirements 4.2 and 4.3, timely and regular disclosures on actual transactions related to resource-backed loans should be disclosed. The disclosed information should be no older than the second-to-last complete accounting period. For example, data for the financial year 2022 must be published at the latest by 31 December 2024 (in accordance with Requirement 4.8).

|

Total volumes traded during the reporting period[2] |

|

Encouraged disclosures

|

Further details on the loan |

|

Where to disclose information

Information on resource-backed loans is often difficult for citizens to access. Disclosures may be made via various sources, including government and parliament channels (public statements, annual reports, bond prospectus, agreements ratified by the parliament), EITI Reports, annual company reports, debt sustainability assessments by financial institutions such as the IMF and media sources. Additionally, companies buying oil, gas and minerals from governments are expected to disclose information on resource-backed loans they provide to governments and SOEs to align with disclosures made by EITI implementing countries.

Examples of disclosures and oversight

MSGs have the opportunity to enhance the comprehensiveness, detail and accessibility of disclosures related to resource-backed loans. This will enable the data to inform public debate about the benefits and challenges associated with such loans. MSGs can draw lessons from EITI implementing countries that are already reporting this information.

Chad

Restructured prepayment agreement with Glencore

In June 2018, Chad’s national oil company Societé des Hydrocarbures du Tchad (SHT), Glencore Energy UK Ltd (Glencore), and a group of financial institutions agreed to restructure prepayment agreements made in May 2013 and April 2014. Under the initial agreement, two disbursements had been made to the Chadian government worth USD 600 million (paid in two tranches) and USD 1.45 billion respectively (and subsequently consolidated and restructured in December 2015). These loans contributed to Chad’s investment into the Doba oil block, which was operated by a consortium of companies. The 2018 restructuring allowed for repayment through crude oil deliveries from SHT over a 10-year period.

EITI reporting on Glencore resource-backed loan

ITIE Tchad has been regularly disclosing information on to the resource-backed loan with Glencore. Chad’s 2018 EITI Report provides information on the prepayment agreements from 2013 and 2014, as well as the restructured agreements from 2015 and 2018 restructuring. It includes the loan amount, payment modalities, repayment schedule until 2027, interest rates, restructuring fees, the volumes and values of crude oil delivered for loan repayment in 2018 (broken down by buyer) and the outstanding debt as of 31 December 2018. Chad’s MSG and national secretariat played a key role in monitoring the reporting process and collaborated closely with Glencore on data collection and publication.

Complementary company reporting by Glencore

Through its annual reporting on payments to government, Glencore provides complementary and up to date information on the loan. Glencore’s Payments to Governments Report 2020 discloses information on the outstanding loan amount under the 2018 restructured prepayment agreement (USD 1.07 billion as of 31 December 2020, of which Glencore’s participation is USD 359 million). During 2020, SHT delivered a total volume of 7,615 kbbls crude oil, with an aggregate value of more than USD 296 million.

Trafigura

Disclosure of short-term resource-backed loans

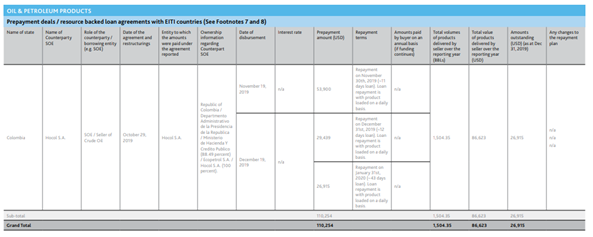

In 2020, Trafigura released it first disclosures on prepayments through its 2020 Payments to Government Report. The disclosures highlighted prepayments between Trafigura and the Colombian state-owned enterprise Ecopetrol, including details on the selling entity, type of product, volumes and values. To enhance understanding of this information, the report provides contextual analysis of the disclosed figures. The disclosures were provided in line with the EITI’s Reporting guidelines for companies buying oil, gas and minerals.

South Sudan and the IMF

Monitoring of resource-backed loans by international financial institutions

In 2019, the IMF held bilateral discussions with the Government of South Sudan to assess recent economic and financial developments, as part of its engagement with member countries. The resulting report highlighted that nearly all of South Sudan’s oil revenue was to repay its financial obligations to Sudan and oil-backed loans. It also recognised that non-transparent oil advances, oil-backed loans, and off-budget transactions undermined fiscal discipline and budgetary integrity, leading to high corruption risks.

The report recommended that the government cease the contracting of oil-backed loans, advances and prepayments. It also recommended that the state’s oil should be sold at spot market prices and that gross proceeds should be transferred directly to the Bank of South Sudan’s oil account, per Chapter 4 article 4.1.9 of the peace agreement signed in 2018.

The report noted that this simplification would help enhance transparency, reduce costs and ensure that oil revenues are fully available for budgetary spending. This case provides a good example of how international financial institutions monitor practices related to resource-backed lending and can provide recommendations for better transparency and management.

Ghana

Using commodity trading data to enhance accountability

Most of Ghana’s oil revenue comes from two long-term sales contracts with the Russian trader Litasco and the Chinese state-owned company Unipec Asia, with the latter tied to the government’s loan from China Development Bank. Ghana’s national oil company, GNPC, has a long-term sales agreement with Unipec Asia signed as part of the 2011 umbrella agreement of a USD 3 billion loan between the Government of Ghana and China Development Bank. Under this long-term sales agreement, which came into effect in February 2012, Unipec Asia, a trading subsidiary of Chinese state-owned Sinopec Group, has agreed to the purchase of five cargos per calendar year from the Jubilee field for 15.5 years.

The offtake agreement between GNPC and Unipec Asia has also been disclosed on the GHEITI website. Civil society organisations, with support from the Natural Resource Governance Institute (NRGI), have analysed and scrutinised the agreement.

Further resources

- EITI (2020), Guidance Note: Infrastructure provisions and barter arrangements.

- EITI (2020), Guidance Note: Quasi-fiscal expenditures.

- NRGI (2020), Resource-Backed Loans: Pitfalls and Potential.

- Trafigura (2020), Prepayments Demystified: an addendum to the Commodities Demystified guide.

- Public Eye (2020), Trade Finance Demystified: The Intricacies Of Commodities Trade Finance.

- IMF and World Bank (2020) Collateralized Transactions: Key Considerations for Public Lenders and Borrowers.

- World Bank (2022) Enhancing Debt Transparency by Strengthening Public Debt Disclosure Practises.

- World Bank (2022) Resource-Backed Loans in Sub-Saharan Africa.

Footnotes

[1] If the borrowing entity is an SOE and repayments of the loan (including interest and/or the principal amount) are not recorded in the national budget, this would usually be considered a quasi-fiscal expenditure. See the EITI’s guidance on disclosures related to off-budget expenditures of state-owned enterprises: EITI (2020), Guidance Note: Quasi-fiscal expenditures.

[2] These disclosures should correspond to EITI disclosures being made on the volumes of oil, gas and minerals sold by the state or by SOEs on behalf of the state and revenues received from the sale, in accordance with Requirement 4.2.

Связанные материалы