Upstream Oil, Gas and Mining SOE Governance Challenges

- Governance Challenges and the Role of International Reporting Standards in Improving Performance

Download document in PDF

Executive Summary

State-owned enterprises (SOEs) can be described as business-oriented majority government-owned institutions that sell goods or services or manage state equity and keep their own balance sheets. More than 146 of these enterprises have been established in the upstream oil, gas or mineral sectors, with almost a third focused primarily on mining. They often play important, sometimes critical roles in exploiting natural resources and managing the extractive sector in their respective countries. While some are commercial or operational companies—selling crude oil or raw minerals, managing state equity or participating directly in extractive operations—others are regulatory or administrative entities or instruments of economic or state development.

Not only do mandates and operations vary significantly from SOE-to-SOE, but so does performance. SOEs can generate significant revenue for the state, enable a government to exercise greater control over the sector, help improve local technologies and skills, or address market failures. For instance, the presence of an SOE in the upstream oil sector is associated with higher government take. Some SOEs such as Abu Dhabi’s ADNOC, China’s Sinopec, Norway’s Equinor, Saudi Arabia’s Saudi Aramco and Thailand’s PTT have arguably generated significant value for their primary shareholder, the state, and have made substantial economic contributions to their countries.

Yet financial and governance challenges are common among many others. Among OECD countries, oil, gas and mining enterprises had the highest rates of corruption and irregular practices among SOEs over the last three years. These sectors are likely to be characterized by natural monopolies, are particularly secretive and are engaged in high-value procurement projects, which makes them targets for rent seekers.

Each context is unique, however, the problems of slow project development, high costs, low revenues, excessive liabilities and inefficient allocation of revenues between SOEs and other public entities have led to many billions of dollars in losses annually. These billions represent a lost opportunity to improve healthcare, education or infrastructure around the world. Mismanagement of SOEs also empowers and sometimes enriches officials and those with connections to the government at the expense of the average citizen.

Inadequate transparency and oversight is one cause of SOE mismanagement and large losses. The 2017 Resource Governance Index scores bear out a tendency towards opacity among SOEs. 58 percent of national oil companies and 72 percent of national mining companies measured in the index do not disclose enough quality, timely information about their activities and finances to carry out proper external assessments. Furthermore, less than 60 percent of countries implementing the 2016 EITI Standard have achieved meaningful or satisfactory progress against the standard that requires disclosure of information on SOE roles, responsibilities, operations and finances.

International organizations have developed a collection of guidelines and standards to improve the transparency and governance of extractive companies, state-owned enterprises or public sector entities. There are significant commonalities among them, suggesting an international consensus on many elements of what constitutes good governance and what information ought to be disclosed. Among the most relevant documents are:

General public sector performance guidelines or standards

- PEFA Framework (World Bank 2016)

- Tax Administration Diagnostic Assessment Tool (TADAT)

- The High-Level Principles on Fiscal Transparency, Participation and Accountability (GIFT 2018)

SOE- or extractive-specific governance or reporting guidelines

- Guidelines on Corporate Governance of State-Owned Enterprises (OECD 2015) and Accountability and Transparency: A Guide for State Ownership (OECD 2010)

- Corporate Governance of State-Owned Enterprises: A Toolkit (World Bank 2014)

- Guide to Extractive Sector State-Owned Enterprise Disclosures (Natural Resource Governance Institute 2018)

- G4 Sustainability Reporting Guidelines, Oil and Gas Sector Disclosures and Metals and Mining Disclosures (Global Reporting Initiative 2012 and 2013)

- How to Improve the Financial Oversight of Public Corporations (IMF 2016)

- Report on the Good Governance of the National Petroleum Sector (Chatham House 2007)

- 10 Anti-Corruption Principles for State-Owned Enterprises (Transparency International 2017)

SOE- or extractive-specific governance or reporting standards

- The EITI Standard 2016 (EITI 2017)

- Fiscal Transparency Code and Handbook (IMF 2014; 2018) and Guide on Resource Revenue Transparency (IMF 2014)

- International Financial Reporting Standards (International Accounting Standards Board)

- Oil and Gas Exploration and Production Sustainability Accounting Standard (Sustainability Accounting Standards Board 2014)

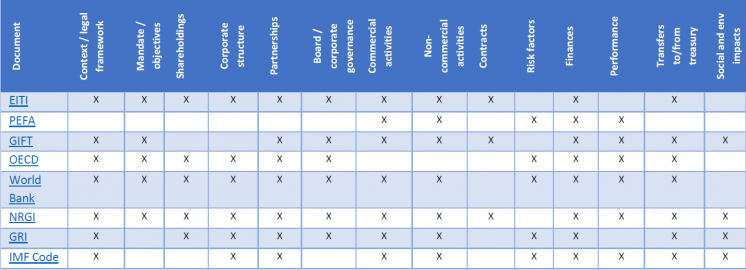

Each of these 14 documents covers a different set of topics relevant to SOE governance (see table below). Some are guidelines while others are standards. Some are SOE- or extractive-specific while others apply to all companies or all sectors. Technical support is available for help in implementing 10 of the 14 documents.

Table. Topics covered by a subset of guidelines and standards

The World Bank Toolkit’s Appendix E, the NRGI Guidelines and GRI’s G4 Guidelines and sector specific guidance are perhaps the most useful for improving extractive SOE disclosures. Other documents are more relevant for improving SOE governance or performance beyond public reporting. To date, a definitive internationally-accepted extractive SOE disclosure standard has not been developed. The 2016 EITI Standard and NRGI’s Resource Governance Index methodology are the closest available tools.

Despite the existence of these guidelines and standards and their implementing mechanisms, public disclosures and SOE performance remain deficient. International initiatives rarely reflect on-the-ground realities and there is often weak in-country demand for reform. The EITI could play a leading role in improving SOE performance. Options include: advocating for improved extractive SOE disclosures by piggybacking on other global initiatives; establishing a new technical assistance facility; building on and expanding EITI implementation guidelines; helping to establish a new international forum or certification scheme; or endorsing a new standard for SOE transparency, either building on existing initiatives or starting from scratch. The EITI could also partner with other international organizations to leverage their networks and expertise.

The EITI Board and Secretariat could consider these options, with the aim of establishing or building on initiatives that lead to tangible improvements. Ideally, any initiative would work in partnership with SOE owners since they are the ones with the greatest interest in improving SOE performance.

Author

The report is written by Andrew Bauer, public sector finance and governance consultant.