Using the EITI to further strengthen government systems is key to impact.

Now that Mongolia has been found to achieve at least satisfactory progress on all EITI requirements the key question on stakeholders’ lips is “Where to go from here?”

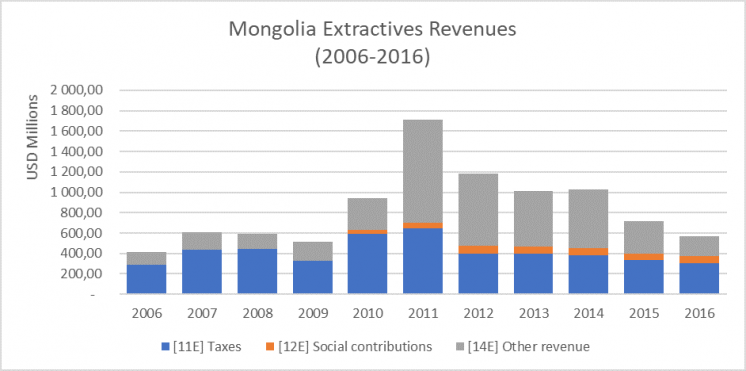

The USD 9.3bn in mining, oil and gas revenues collected over 11 years (2006-2016) tells an interesting story. Mongolia’s revenues have fluctuated significantly year to year. This is largely because they have increasingly relied on royalties which are based on production which is, in turn, heavily affected by commodity prices.

Volatile revenues

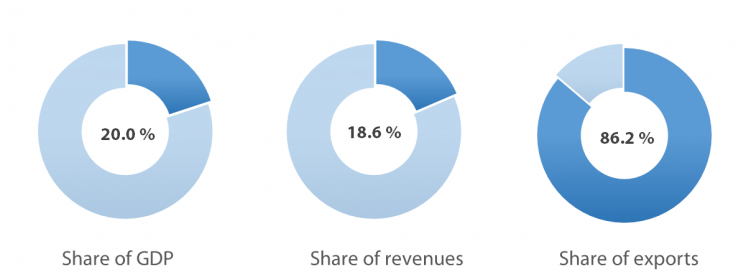

In 2016, Mongolia depended on mining for a fifth of both GDP and government revenues and around 90% of export earnings. The economy has oscillated from repeated booms and busts over the country’s 28 years as a young democracy. In 2011, the country topped the world’s growth charts with 17.5% annual GDP growth. By 2017, Mongolia was undertaking its sixth IMF rescue package due to a fall in mineral commodity prices and investor sentiment.

Source: 2016 EITI Report summary data

Mongolia's EITI Data from 2006-2016 shows how extractives revenues returned to their pre-boom levels in 2016, while the economy had more than doubled:

Source: 2016 EITI Report summary data

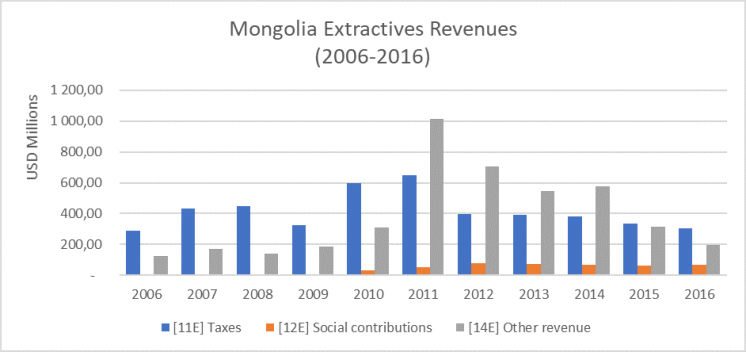

Shifting revenue profile

A closer look at the underlying data yields more interesting insights. Non-tax revenues (such as royalties and dividends) increasingly replaced tax income as the primary driver of extractives revenues. Until 2012, this surge in non-tax revenues was driven by the tripling of coking coal and iron ore exports to China (over 2008-2011), rising international mineral prices and new production from large mining projects like Oyu Tolgoi.

Source: 2016 EITI Report summary data

From 2013, revenues in Mongolia were hit by lower commodity prices, a slump in Chinese demand and new rules curbing gold production in 2012-16. New large mining projects such as Oyu Tolgoi (which started production in 2013) have not yet brought in much tax revenues because of the period for offsetting project development costs against taxable income. However, they have significantly increased copper and gold royalties.

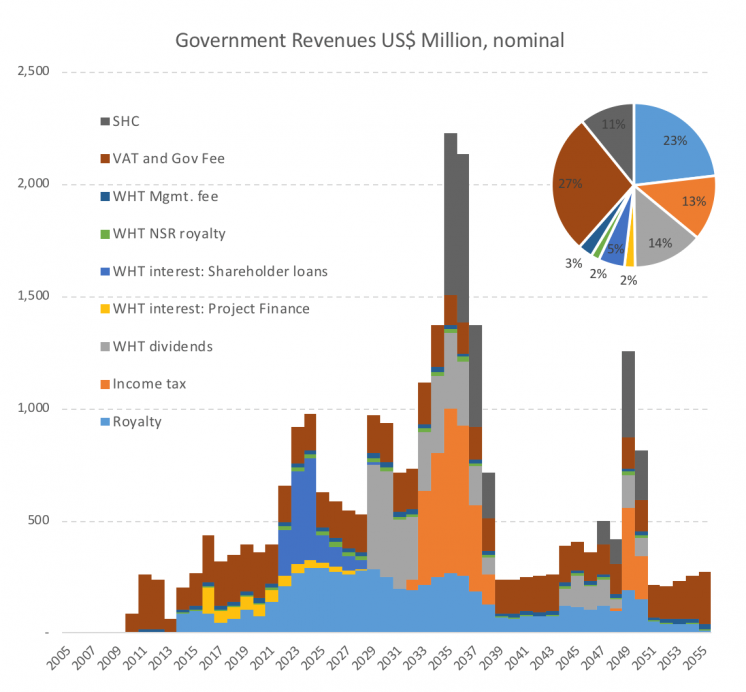

An open financial model of the Oyu Tolgoi mine by OpenOil (in 2017), based on public documents including EITI data, shows how there is likely to be a shift back towards tax revenues from around 2030:

Source: OpenOil open financial model of Oyu Tolgoi

From data to analytics

The access to EITI data has had other important impacts, including empowering citizen oversight.

In a country with over 600 new mining licenses awarded every year, the 2016 EITI Report found deviations from licensing procedures in 20% of cases examined. Amidst a temporary licensing freeze as a new government was formed in October 2017, these findings were timely. Combining data on calculations of subnational transfers in the 2016 EITI Report (pp.101-104) with the Finance Ministry’s portal for tracking transfer executions, any citizen can assess whether their provincial governments received their dues. Contracts, now available through the Open Society Forum’s extractives contracts portal, provide the key terms of agreements, including with local communities. The EITIM Data Portal (EITI Mongolia) allows mining communities to track companies’ social expenditures and direct payments to subnational governments, empowering them to monitor compliance with contractual obligations.

Embedding transparency

Mongolia has started assessing the extent to which data required under the EITI Standard is already accessible from existing government and company systems or websites.

Preliminary findings are that around two-thirds of the information required to maintain this level of transparency is – or can easily be – available through existing systems (see list below).

The remaining information, mainly related to state-owned enterprises’ public reporting, may require more work to systematically disclose. EITI reporting will likely continue to focus on those key gaps in public information.

Less time spent on data collection should free up more time to focus on analysis.

Examples of existing systems in Mongolia

| Operated by the Ministry of Justice and Internal Affairs. The portal provides access to full-text of all laws, regulations and tax rules in Mongolia. |

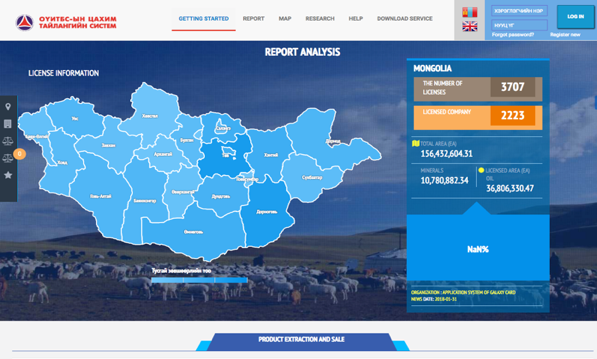

| Operated by MRPAM. The Computerized Mining Cadastre System provides near-complete information on all extractives licenses (company name, dates of award and expiry, commodities covered and coordinates). |

| Operated by MRPAM. Portal provides geological data and exploration updates.

|

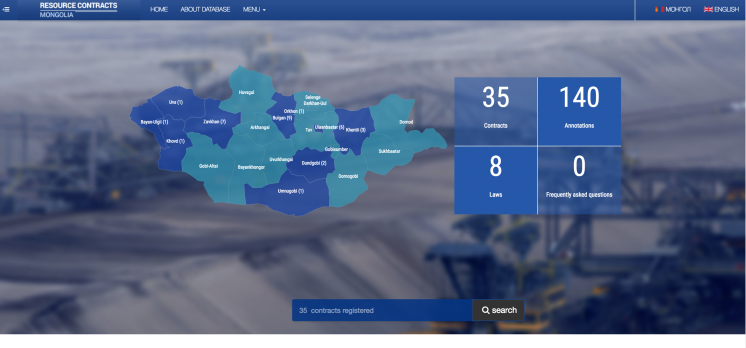

| Operated by the Open Society Forum. Portal provides full-text of 35 contracts (and 140 annotations) to date. Updated upon publication of new contracts. |

| Operated by EITI Mongolia. Portal integrates 11 years of EITI data on extractives revenues, alongside geo-tagged data on licenses, production and payments. Company payments reported online within three months of fiscal year-end through the eReporting system (see new case study here). |

| Operated by the Government’s Cabinet Secretariat. Portal provides details of all expenditures over USD 2500 by all government entities (including Ministries, agencies and state-owned enterprises). |

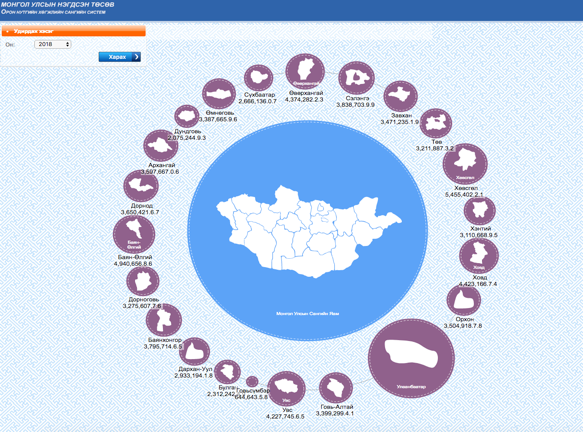

| Operated by the Finance Ministry. Portal tracks subnational transfers to aimags (provinces) and soums (districts). The 21 aimags upload information on fund allocations including description of projects, funding, clients, contractor, start and end dates. |

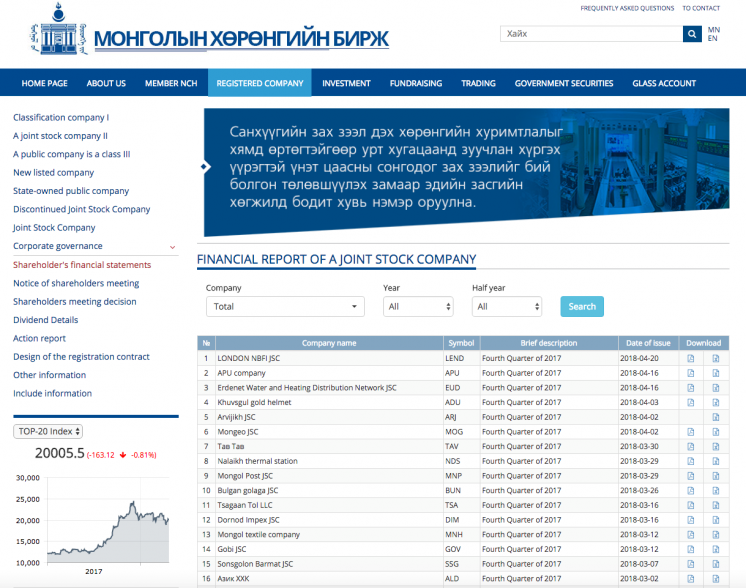

| Corporate reporting By companies, including some state-owned enterprises.

Filings on the stock exchange and corporate websites provides some information, but not sufficiently disaggregated.

|