Contract transparency

Strengthening public oversight of extractive sector agreements

Contracts, licenses and associated agreements are important elements of a country’s legal framework. They explain the rights and obligations of all parties involved in the exploration and production of oil, gas and minerals.

By shedding light on the rules and terms that govern extractives projects, contract transparency can help curb corruption and empower citizens to assess whether they are getting a good deal for their resources. Publication of contracts gives visibility on how much revenue is expected to flow to national and subnational governments. This information can be crucial in contexts where precious revenues are impacted by market volatility and emerging energy transition policies.

When EITI countries commit to contract transparency, they accept to publicly disclose the full text of any contract, license, concession or other agreement governing the exploitation of oil, gas and mineral resources.

The EITI Standard requires implementing countries to disclose all contracts and licenses that are granted or amended from 1 January 2021. Disclosures related to contract transparency are covered by EITI Requirements 2.2, 2.3 and 2.4.

Contract transparency in numbers

- 40+

- EITI countries have disclosed contracts

- 900+

- contracts have been published by EITI countries

- 40+

- companies support contract transparency

News, blogs and events

USAID extends partnership with EITI to advance anti-corruption work and strengthen domestic resource mobilisation

Strengthening the data-driven fight against corruption with the new EITI Standard

Meeting the Expectations for EITI supporting companies

Colombia achieves moderate score in EITI implementation

Republic of the Congo: Modelling EITI data to strengthen the government’s future oil revenues

Company commitment

Contract disclosure makes it easier for companies to show that they comply with their financial and social obligations, helping them to address reputational risks. Disclosing the terms of contracts supports open, fact-based dialogue that can build trust, reduce conflict and reinforce a company’s social license to operate.

Companies promote contract disclosure by committing to the Expectations for EITI supporting companies, and members of the International Council on Mining and Metals (ICMM) have adopted a policy position on contract transparency in line with the EITI Standard.

Publishing contracts allows us the opportunity to enter into open, fact-based, conversations with stakeholders at every level, giving interested parties a clear understanding of everyone’s roles and responsibilities in a project. It also enables voters in our host countries to see how much money (in the form of taxes, royalties, dividends, etc.) will flow from our projects to the relevant government entities, and to hold them to account for how it is spent.

Contract transparency in action

Ghana

Ghana’s journey to contract disclosure has been possible due to combined efforts by governments, companies and civil society. In February 2018, the government launched an online public register with 18 major petroleum contracts, responding to increased demands for contract transparency.

This has enabled the government to strengthen its systems and show that government and companies have nothing to hide, thereby promoting a more and competitive investment climate. This practice also enables effective enforcement of rules and regulations and provides a powerful incentive for officials to negotiate strong contracts in Ghana’s petroleum sector.

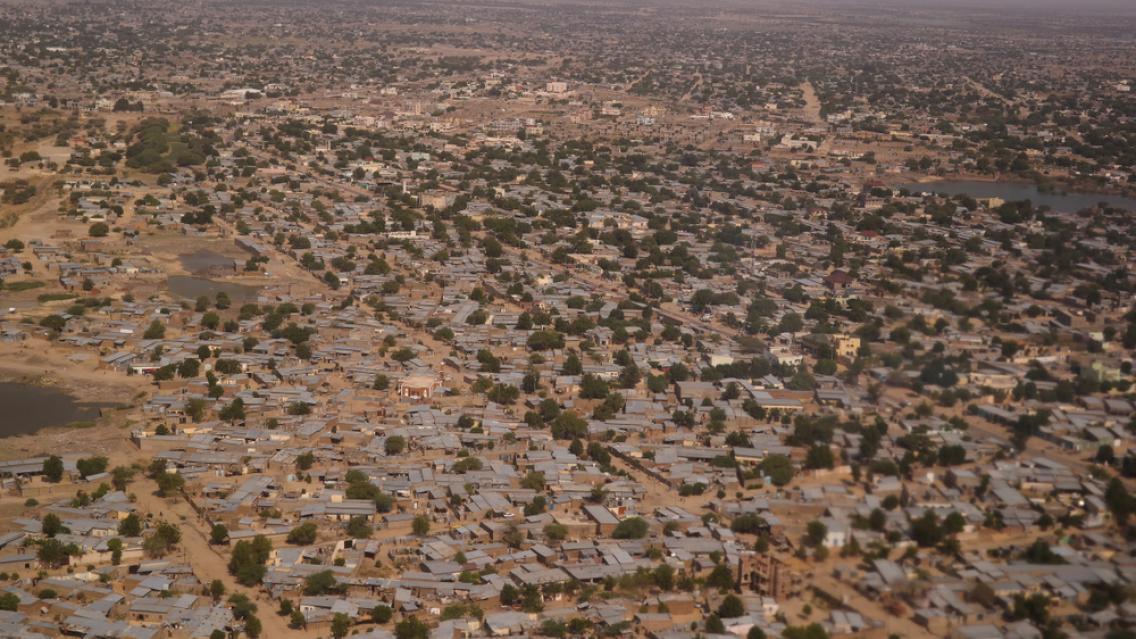

Chad

As a fragile state, Chad lacks the resources to systematically publish contracts and licenses online. Yet commitment from the government, along with the national secretariat’s innovative and solution-oriented approach, has paved the way to contract transparency. Following a decree in November 2019, ITIE-Chad collated existing contracts in open data formats, available online.

Publications and resources

Contract Transparency Network

The Contract Transparency Network is a forum for governments to share experiences, provide expertise and champion the publication of contracts within EITI. The network is comprised of EITI implementing countries who aim to show leadership on this agenda and rally support from other governments to make contract transparency the default practice.