Commodity trading

Shedding light on how oil, gas and minerals are bought and sold

In some cases, extractive companies pay governments for the right to extract resources with in-kind payments of oil, gas and minerals. The state or the state-owned enterprise (SOE) then sells these physical resources to commodity trading companies or domestic refineries. Commodity traders may also provide resource-backed loans to governments or state-owned companies in exchange for future production of commodities.

Almost half of total government revenues reported through the EITI come from the sale of oil, gas and minerals to commodity trading companies. The scale and significance of these payments make them a matter of public interest. State-owned enterprises and commodity traders making payments to governments have been facing increasing demands from advocates and policymakers to adopt more transparent business practices.

Without transparency over the terms of these transactions, commodity trading is vulnerable to corruption and can jeopardise public revenues. Commodity trading transparency ensures that all parties understand the terms on which trades take place and how these may affect the funds available for public expenditures and development.

The EITI Standard requires governments, state-owned enterprises or third parties appointed by the state to disclose the revenues collected from the sale of oil, gas and minerals, as well as the volumes sold broken down by buying company. Disclosures related to commodity trading are covered by EITI Requirements 3.3 and 4.2.

Reporting guidelines for companies buying oil, gas and minerals

Our reporting guidelines and templates are designed for companies buying oil, gas and minerals from governments seeking to disclose their payments to governments in their own company reports.

News, blogs and events

Meeting the Expectations for EITI supporting companies

EITI launches 2023 EITI Standard

Republic of the Congo: Modelling EITI data to strengthen the government’s future oil revenues

How the EITI is being used to fight corruption

Statement from the EITI Board Chair on the Glencore bribery case

Guinea achieves high score in EITI implementation

New guidelines to promote transparency on commodity trades

Sustainable debt or pending threat? Shedding light on resource-backed loans

Commodity trading transparency in action

Indonesia

In 2018, Indonesia EITI published a report dedicated to transparency in commodity trading, covering 1,900 oil sale transactions. These were reported at a total value of USD 4.74 billion by the petroleum sector regulator SKK Migas. The disclosures included the volumes sold and revenues received by the state, estimated prices, forex rate, payment receipt date and country of destination. All data points were disaggregated by cargo.

The report identified opportunities to improve transparency in the selection of buyers and gas and LNG sales. It also recommended more detailed disclosures to allow the public to better understand whether the government was getting a good deal from its sales. The findings stimulated public debate on corruption risks related to commodity trading.

Iraq

Iraq has been disclosing information on commodity trading through EITI reporting since 2011. All oil and gas produced in Iraq is the property of the state. The State Organisation for Marketing of Oil (SOMO) sells crude oil to international buyers and remits the proceeds to the Development Fund of Iraq, net of its costs and margins.

Iraq’s EITI Reports covering fiscal years 2009-2015 include reconciliation of oil sales disaggregated by buyer and the four main export destination regions. The reports also include a description of the sales process, crude oil sale contract template, the buyer selection process and average monthly prices.

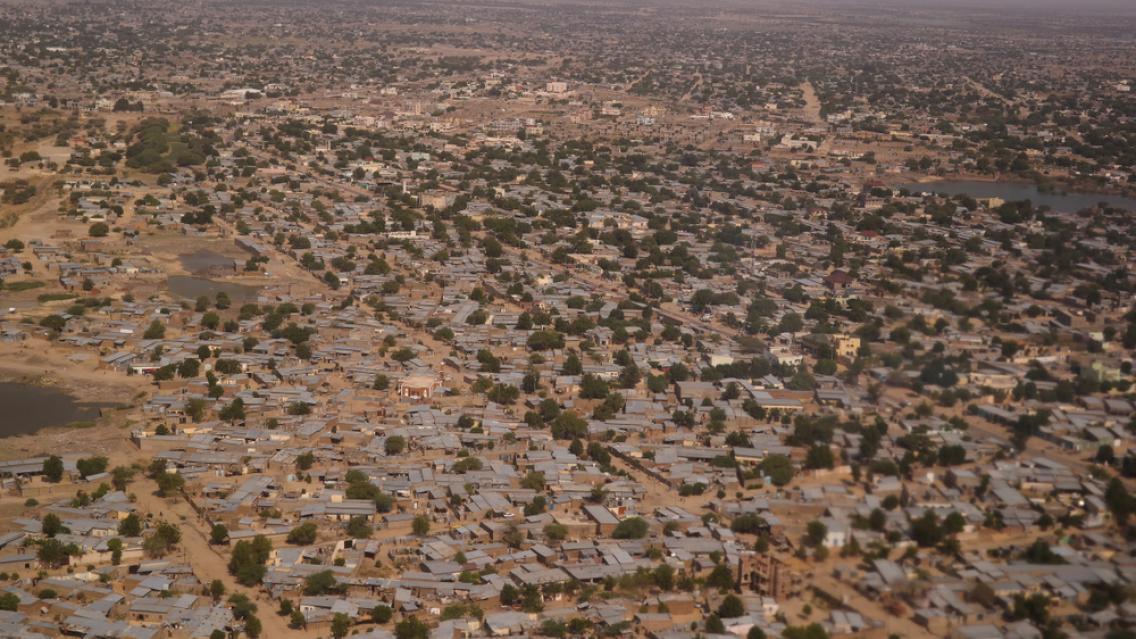

Chad

EITI Reports show that Chad borrowed USD 600 million in 2013 from an oil trading company, using future oil production as collateral for the loan. In 2014, Chad borrowed an additional USD 1.45 billion from Glencore to be repaid from the government’s share of oil. The data showed that Chad was using over 90% of its oil revenues to repay the loan in 2015.

Following the publication of this information, the government restructured the deal several times to make its debt payments more sustainable, most recently in the summer of 2018. Continued disclosures such as those found in Chad EITI’s reporting allows the government and civil society to monitor the progression of these loan repayments in the future.

Transparency in the first trade

This report outlines how commodity trading disclosures have been integrated into EITI reporting practices and highlights examples from pioneering countries.

Commodity trading working group

Since 2015, leading governments, state-owned enterprises, commodity traders and civil society organisations have participated in the EITI multi-stakeholder working group on commodity trading with the aim of helping the EITI advance commodity trading transparency.

The working group draws together expertise and guides EITI and host governments implementing the EITI in their efforts to develop and implement disclosure requirements of government-owned commodities.

The EITI welcomes wide participation in the working group from commodity trading companies, civil society, host and home countries governments and state-owned enterprises. Interested parties are invited to contact the EITI International Secretariat at secretariat@eiti.org.