Summary

In some countries, revenues that are generated from the transport of oil, gas and minerals can have a significant contribution to the economy. Income from the transport of oil, natural gas and minerals en route to their ultimate market destinations can be difficult to track and are therefore vulnerable to mismanagement or corruption. Transportation data can help citizens affected by transportation infrastructure (e.g. petroleum pipelines) to understand the importance of revenues generated from transportation, as well as the commodities, volumes and parties involved in such activities.

Greater transparency can promote greater accountability and efficiency in these activities. Until 2013, EITI reporting focused on “upstream” extractive sectors, with only a few countries voluntarily disclosing and reconciling transport payments. According to Requirement 4.4 of the 2019 EITI Standard, governments and state-owned enterprises (SOEs) are expected to disclose revenues received from the transportation of oil, gas and minerals, where these revenues are significant. This includes revenues collected by the state and SOEs from oil, gas and minerals transported by rail, by road or through pipeline and ports.

This note provides guidance to multi-stakeholder groups (MSGs) on how to report on transportation revenues as part of EITI implementation. It offers examples from implementing countries, including on the use and dissemination of data. The guidance is divided into two sets of steps: Steps 1 to 3 address how to assess applicability and materiality, and Steps 4 to 5 provide guidance on how to prepare for and ensure adequate disclosure.

-

Which oil, gas and mining transportation arrangements exist? How are the government and state-owned enterprises involved in transportation of natural resources?

-

Does the government derive revenues from oil, gas and mineral transportation in the country? How are relevant taxes and payments calculated?

-

From which companies do the government and state-owned enterprises collect transportation revenues? How much oil, gas and minerals are transported within or through the country?

-

How important is the midstream extractive sector for the government and its revenues?

Overview of steps

| Steps | key considerations | examples |

|---|---|---|

|

Steps 1 to 3: Applicability of transportation revenues |

||

|

Step 1: |

|

|

|

Step 2: |

|

|

|

Step 3: |

|

|

|

|

Steps 4 to 5: The MSG should complete these steps if transportation revenues are material |

|

|

Step 4: |

|

|

|

Step 5: |

|

|

How to implement Requirement 4.4

MSGs are recommended to adopt the following step-by-step approach for reporting on revenues from the transportation of oil, gas and minerals. Upon determining applicability or materiality, the MSG’s discussions and decisions must be documented, even in cases where transportation revenues are deemed “not applicable". Documentation can be undertaken through MSG meeting minutes, scoping studies, EITI disclosures or other publicly accessible documents.

Steps 1 to 3: Applicability of transportation revenues.

Step 1: Identify the extractive commodities transport system(s) in the country and the actors involved

In identifying which transportation systems might be relevant for the EITI process, the MSG should identify:

- Which oil, gas, and mineral commodities are transported by government entities and state-owned enterprises (SOEs);

- Who owns the transport system(s) in the country, as well as the role of the state, state-owned enterprises and private companies;

- Which government entities collect the payments from transportation and should disclose data;

- What monitoring systems are in place for transported commodities.

The MSG is encouraged to engage with the parties involved in the provision, management or regulation of the relevant transportation systems. This will help to provide an understanding of what information is publicly available.

Transportation revenues: Transportation through versus within a country

The EITI Standard does not distinguish between transportation revenues generated from commodities “in transit” (i.e., transported through the country) and commodities transported or stored domestically (i.e. where commodities enter and exit transportation infrastructure within a country’s borders). Both cases are therefore included in the scope of EITI Requirement 4.4.

For any type of transportation revenues to be excluded from full disaggregation, countries must demonstrate that they are immaterial by disclosing the totals and percentage relative to total revenues.

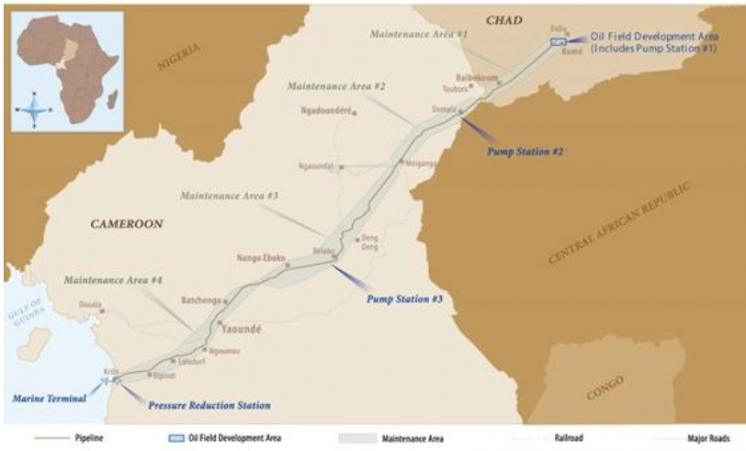

Chad and Cameroon: The Chad-Cameroon pipeline

In 1996, the governments of Chad and Cameroon signed a bilateral agreement to develop a joint pipeline to transport petroleum from oil fields in Kome, Chad to an export terminal in Kribi, Cameroon.

The pipeline is managed by two joint ventures: Chad Oil Transportation Company (TOTCO), and the Cameroon Oil Transportation Company (COTCO), and both governments are minority shareholders. Companies using the pipeline’s services must pay a transit fee proportionate to the distance transported on either side of the border, and the Chadian and Cameroonian governments receive revenues as a result of their direct ownership interests. Transportation revenues received by TOTCO and COTCO are disclosed in their income from transportation services, disaggregated by each paying company.

Nigeria: Equity interests in transportation joint ventures

Nigeria’s 2018 EITI Oil and Gas Report discloses revenues received from the use of pipelines. According to the report, the national oil company Nigerian National Petroleum Corporation (NNPC) holds an interest in several joint ventures (JVs) that operate pipelines, including Chevron Nigeria Limited (CNL), Nigerian Agip Oil Company (NAOC) and Shell Petroleum Development Company of Nigeria (SPDC).

As part of its equity share, NNPC is entitled to a share of pipeline fees that the JVs receive for transporting crude oil using the pipelines. Since the operating companies of each JV are responsible for determining the fees paid by customers for use of the pipeline infrastructure, these fees vary for each pipeline.

The government earns 1-2% of its extractive sector revenues via transportation fees. As noted in Nigeria’s 2019 Validation process, Nigeria EITI (NEITI) is exploring how disclosures can be improved by also including equity revenues from other companies where NNPC holds minority interests, such as Nigeria LNG Limited (NLNG), where dividends can be argued to represent transportation revenues.

Malawi: Concession fees

Malawi receives concession fees from Vale Logistics Limited and Central East African Railways Company Ltd for transportation of coal through its territory. These concession fees amount to 4% of gross turnover of the concessionaire’s product transportation by rail.

However, these fees are not directly related to transportation volumes, and the government does not have any ownership in the railway. The collected revenues are thus not considered as transportation revenues. Rather, the fees can be considered regular taxations of a private company in the transportation sector. Government revenues from transportation companies owned by the state could still be an informative proxy for discussions on materiality, as exemplified under Step 3.

Step 3: Assess the materiality of the transportation revenues

Where the MSG has determined that there are transportation revenues, the MSG must demonstrate whether they constitute a significant revenue streams in the extractive sector.

The materiality of transportation revenues can be determined as part of an annual exercise outlined in Requirement 4.1b. The MSG is encouraged to set a different materiality threshold for transportation revenues than other forms of revenue. The MSG should document its approach through MSG meeting minutes, scoping studies, EITI disclosures or through other publicly accessible documents.

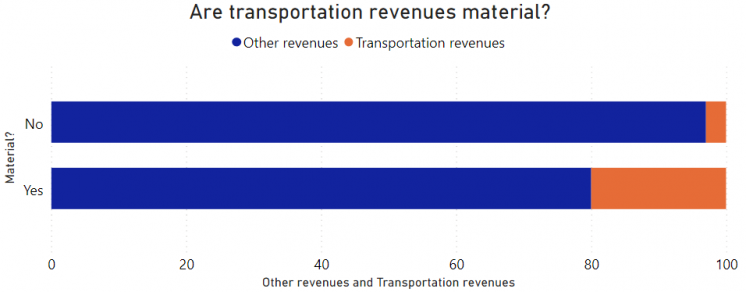

As can be seen in the graph on this page, where transportation revenues are small compared to other revenues (top bar), transportation revenues can be demonstrated to not be material or significant. However, where transportation revenues are large compared to other revenues (bottom bar), transportation revenues should be deemed “material” or “significant”.

In some cases, the data needed to make this assessment will already be publicly available from companies, government authorities or other sources. In other cases, it may only be possible to estimate the size of the payments through consultations with stakeholders, in particular with SOEs.

While transportation revenues may be small compared to other revenue streams, reporting on such payments might be important for some stakeholders, as the effective transportation may be an essential feature of the extractive sector production system and energy access of countries.

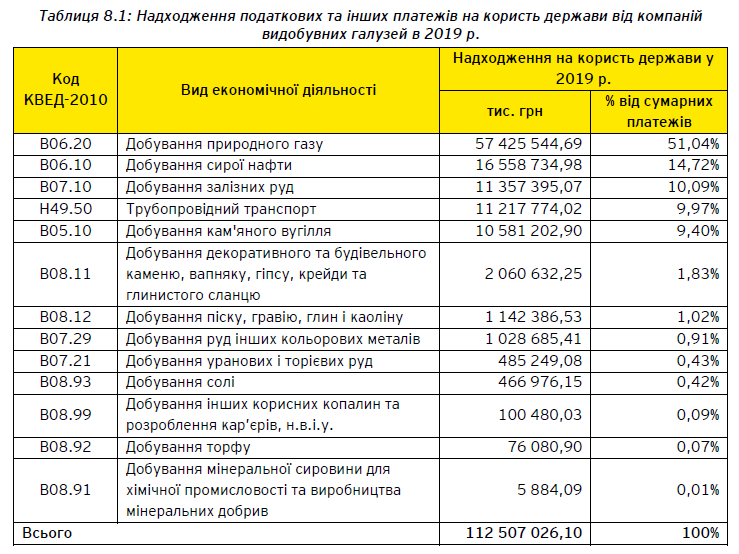

Ukraine: Scoping transportation revenues for EITI reporting

In agreeing the scope of its 2019 EITI Report and determining which sectors to include for further disaggregation, EITI Ukraine used their national industry classifications. These correspond with international standards such as the International Standard Industrial Classification of All Economic Activities (ISIC) of the UN which is used by national statistics offices in all its member countries. ISIC code 49.50 refers to transportation via pipelines allowing Ukraine EITI to identify government revenues from gas transportation and transit companies in data provided by the tax authorities.

The 2019 EITI Report shows that the pipeline transportation sector accounted for almost 10% of government revenues from midstream and upstream extractive activities. The sector was therefore determined to be material, and subject to further disclosures. Alternatively, Ukraine could have identified SOEs involved in commodity transportation on behalf of the government and used their income from transportation services as an indication for how much the government earns from the sector. In Ukraine’s case, SOEs’ earnings from transportation services is what should be fully reported and disaggregated as part of Requirement 4.4.

Steps 4 to 5: The MSG should complete these steps if transportation revenues are material.

Step 4: Analysis of legal and practicable barriers to reporting and publishing data

Where the MSG has determined that transportation revenues exist, are applicable and are material, fully detailed disclosure of transportation revenues is expected. Where there are significant legal or practical barriers to disclosure, the MSG must consider the issue, document its approach, clarify what these barriers are and develop a plan indicating how to overcome them.

Common obstacles include confidentiality clauses in government and company contracts, lack of disclosure platforms, absence in monitoring systems or conflicting departmental responsibilities.

Fictitious example of Transparenciana: Legal or contractual limitations to disclosure

In Transparenciana, 10% of government extractive revenues are derived from transportation services through a state monopoly dubbed the “National Gas Transportation Company” (NGTC). The company is responsible for operating and maintaining gas pipelines in the country, and enters into agreements with private companies based domestically and in other countries. The NGTC provides transportation and transit services via its gas pipeline system, and charges a fee based on volumes and distance transported.

NGTC publicly discloses data on its earnings from transportation services, e.g., through annual publication of its audited financial statements. It also discloses the applicable terms and tariffs used for transportation. However, NGTC faces significant constraints in publishing detailed, disaggregated data on its earnings from each of its customers.

Transparenciana has developed obligatory model contracts for transportation services, which NGTC enters with each of its customers. These model contracts include confidentiality clauses that hinder disaggregation of transportation revenues, which stipulate that disclosure of any data by any party to a third party is prohibited, unless conflicting with other legislation. These confidentiality clauses are applicable for a further five years following the contracts’ termination date.

In this case, the Transparenciana MSG would not be able to provide disaggregated data due to the legal barrier to disclosure. However, since fully disaggregated disclosures are expected in accordance with EITI Requirement 4.4, the MSG should agree activities to include in its work plan that cover the following

-

Identify the precise law that mandates the use of the model contracts;

-

Identify the passage contained within the contract that prohibits disclosure of data, indicate how or why disclosure is prevented and confirm any alternative interpretations of the provisions;

-

Present these assessments and findings through EITI reporting, and identify short or long-term ways to overcome barriers to public disclosure.

Step 5: Development of reporting procedures or improvements in systematic disclosures

Based on the assessments above, the MSG is advised to:

- Improve on existing disclosures of entities involved in transportation of commodities on behalf of the government;

- Develop a reporting procedure for government entities or SOEs as an interim solution.

The precise improvements in existing disclosures or reporting templates are likely to vary from country to country depending on the systems in place.

In accordance with Requirement 4.4, the MSG must ensure that disclosures of transportation revenues are disaggregated by paying company and revenue stream, reported by the recipient entities. It is recommended that the MSG ensure that the government discloses a description of the transportation arrangements, tariff rates and the volume of the transported commodities.

Where feasible, the MSG is encouraged to assess the reliability of data on payments and revenues associated with the transport of oil, gas and minerals.

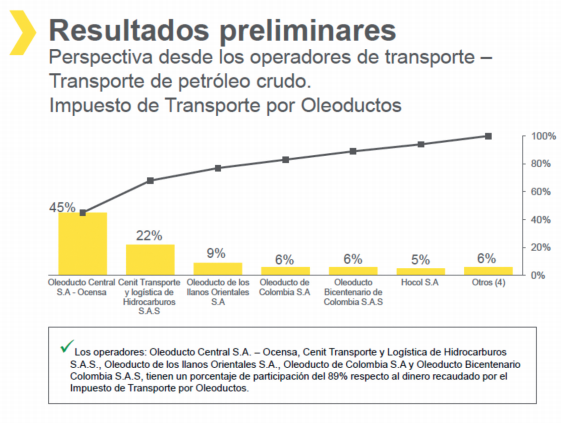

Colombia: Mineral and petroleum transportation revenues

The Colombian government collects taxes and fees related to the transportation of minerals, oil and gas. In 2017, the Colombian MSG commissioned a supplementary report on minerals transportation in Colombia. It included information on the legal framework regulating oil and gas pipelines, coal transportation and port fees. It describes the methodology for calculating fees and the legal and practical barriers for disclosure.

Data from transport operators – collected from national ports, the Ministry of Mines and Energy and other government agencies such as the Agencia Nacional de Infrastructura (ANI) – were used to calculate the transport taxes and port fees paid by extractive companies. The report identified that more than USD 150 million was collected from the transportation of oil, gas and coal, therefore noting that these revenues were material. Disclosures of these payments were disaggregated commensurate with other payments and revenues streams. As these payments and revenues were distributed among 172 municipalities, the MSG chose not to undertake a reconciliation exercise.

Further resources

- EITI International Secretariat (2020), “Connecting the dots with the East Africa Crude Oil Pipeline"

- Norsk Petroleum, “The oil and gas pipeline system"

- DiXi Group, “Online Energy Sector Map of Ukraine”

Related content

USAID extends partnership with EITI to advance anti-corruption work and strengthen domestic resource mobilisation