Services and subcontracting: Unexplored ground for transparency

Services and subcontracting: Unexplored ground for transparency

Companies operating in the oil, gas and mining sector spend between USD 745 billion and 1.3 trillion a year on the procurement of goods and services, according to estimates from the Natural Resource Governance Institute (NRGI). Goods and services range from catering and transportation to highly specialised inputs to exploration and production processes. Suppliers and service providers often make a significant economic contribution in terms of taxes, employment and building local capacity, but surprisingly little is known about the size of this market and the actors involved.

Given the significant investments involved, the procurement of goods and services can in some cases pose governance and corruption risks, according to a recent paper on The EITI’s role in addressing corruption. As of May 2019, 31 of 41 recent Foreign Corrupt Practices Act enforcement actions in the oil and gas sector involved subcontractors or subcontracting processes, according to Stanford Law School FCPA Clearinghouse. Local procurement may exacerbate rent-seeking opportunities, as opportunities tend to favour political elites. In some cases, goods and services may be monopolised, posing further efficiency and governance challenges. There are also risks related to profit shifting through related-party service contractors, which may result in revenue losses.

What can the EITI do?

The EITI’s mandate is not to prosecute corruption cases. It can however provide the data and context necessary for other bodies - such as anti-corruption commissions, civil society and the media - to do so.

One data set that can help mitigate corruption risks in company supplier and subcontractor relationships is information disclosed to meet the EITI’s beneficial ownership requirements. EITI supporting companies are expected to disclose their beneficial owners and to take steps to identify the beneficial owners of direct business partners, including joint venture and contractors. They are also expected to engage in rigorous procurement processes, including due diligence of partners and vendors. The 2019 EITI Standard also encourages improved disclosure related to procurement and subcontracting by state-owned enterprises.

However, over and above disclosures generated through EITI processes, the EITI provides a forum for discussing corruption challenges and their potential remedies, enabling pressure to be brought to bear on agencies or companies that may be at risk. Implementing countries have used the EITI to shed light on different aspects of service contracting, particularly those relating to beneficial ownership, payments to government and local content.

Who owns service contractors and suppliers?

Some countries are expanding the scope of the EITI Requirement on beneficial ownership to cover service contractors. Examples from EITI reporting show how beneficial ownership reporting on suppliers can be used to understand who owns the companies further down the supply chain, and whether they are complying with host country registration requirements.

In Iraq, oil and gas companies were required to disclose details on all secondary contracts worth over USD 100 million. Only one company reported the existence of two secondary contracts meeting the threshold. Iraq EITI cross-referenced the data with beneficial ownership information and found that the service provider did not have a registered branch in the country. The EITI Report documented the breach of the Foreign Company Branches Law, whereby companies are required to register in the country to engage in commercial activity.

How much do service contractors pay to government?

Some countries have expanded the scope of EITI requirements on comprehensive revenue and tax disclosures to cover service providers and subcontractors. This has been complemented with information on the laws and fiscal terms applicable to service contractors in the industry, and information on what taxes or exemptions may apply to suppliers.

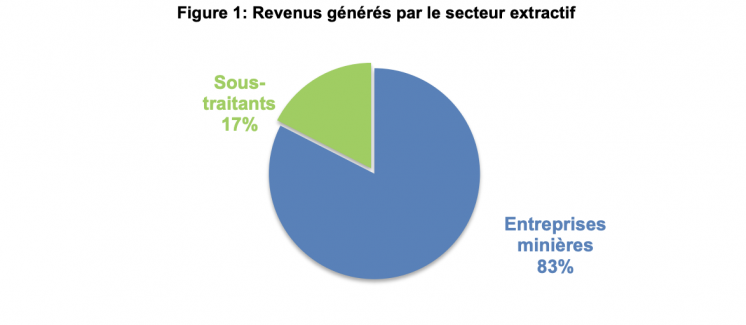

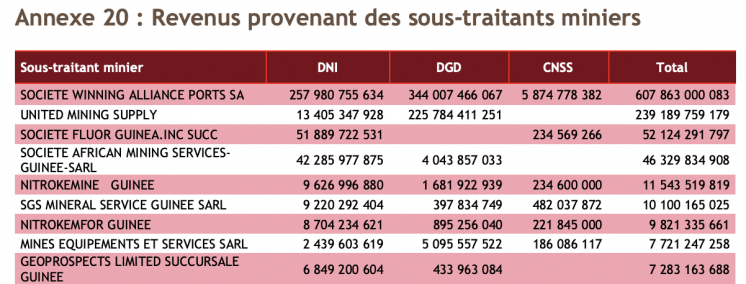

In Guinea, revenues collected from contractors providing engineering, infrastructure, drilling and port services are disclosed. The country’s 2016-2017 EITI Reports showed a four-fold increase in contributions to government revenue (USD 25 million to USD 113 million) resulting from a boom in the mining sector and increasing demand for services. The 2017 EITI Report recommends that the government reviews the process of customs clearance by mining service contractors.

What is the local content in service contracting?

Local content has been high on the agenda for many EITI countries in recent years, with increasing expectations from resource-rich countries about the amount of goods and services that should be purchased locally by extractives companies.

Mali’s 2016 EITI Report included data on employment by subcontractors, disaggregated by national and foreign, temporary and permanent employees. The report also included list of local suppliers, tax identification numbers, the value of goods and services procured in the reporting period, the nature of goods or services and their location.

An existing tool that can help resource-rich countries promote increased local procurement transparency tool is the Mining Local Procurement Reporting Mechanism (LPRM). This provides a set of standardised disclosures that can be used by EITI countries to collect data on mine site local procurement practices and results.

What’s next?

Despite its significance in the extractive industries, the EITI has not yet directly addressed transparency in the goods and services sector at a global level. Practices in implementing countries suggest that that there is both demand and opportunity for the EITI to contribute to a better understanding of the supply and service industry. The EITI will be exploring how transparency and multi-stakeholder dialogue can help tackle these challenges, and mitigate potential corruption risks. Building on forthcoming research by NRGI on governance risks in supplier and service contracting, as well as partner and company efforts, it will engage with implementing countries to gauge interest in piloting the disclosure of data on suppliers and service contractors.